How to Get Cheap Car Insurance Safely

If you’re paying too much for your policy, finding cheap car insurance might feel like chasing the white whale. But don’t despair — there are plenty of ways to save on your premium and get excellent coverage at the same time. In fact, we’ve already detailed the eight best ways to save on car insurance.

That said, there are also plenty of things you shouldn’t do when trying to save on car insurance. Tricks that might save you a chunk of change in the short-term (like opting for less coverage) will actually set you up for financial hardship further down the road. Take a moment to learn about the five most common cheap car insurance mistakes and make sure you’re protected where it counts.

1. Don’t cut coverage in order to cut costs

Oftentimes, people equate “cheap car insurance” with “buying the minimum legal limits.” Buying the minimum amount of insurance will lower your cost, but it’s a dangerous game to play: If you’re found to be at fault in an accident and your insurance doesn’t cover damages, the injured party could sue, putting your assets and future wages at risk.

Justin Lovely, a personal injury lawyer at The Lovely Law Firm, shares this rule of thumb for choosing the right coverage levels: “An easy way to figure it out is to determine how much property you have. For instance, if you own a $300k home, a $50k boat, and two cars at $50k, you need to have liability insurance for $400k, the value of your potential assets to lose.”

Pro tip: When requesting quotes online, most companies give you the option to toggle through policy levels and see how extra coverage will affect rates. Check the different options to see what’s within your budget — better coverage is likely cheaper than you think.

2. Never bend the truth on your application

It might be tempting to fudge the numbers just a little on your car insurance application. You could save by leaving off that pesky speeding ticket, for example, or answering “yes” to a few discounts you don’t actually qualify for.

Here’s the thing: It doesn’t work. Insurance underwriters are like actuaries with CIA clearance. They have the means (and the right) to access any information that might affect your insurance prices. That includes credit score, driving record, address, marital status, job, memberships — you get the picture. People that falsify information in order to get cheaper insurance not only stand to have their policy canceled, but will also have a harder time getting insurance and pay a lot more for it in the future.

3. Avoid a deductible that you couldn’t pay today

Choosing a higher collision or comprehensive deductible is one of the most common ways to save on car insurance. Deductibles can be as high as $2,000, though customers generally see the biggest savings when jumping from $500 to $1,000. If you’re comfortable paying $1,000 out-of-pocket, then choosing the higher deductible is a sound way to reduce rates.

For those that are on the fence, think about it this way: While a lower deductible might cost you a few hundred dollars more in premiums, that cost is spread out over the course of a year. Even a $250 price hike breaks down to only $20 extra per month. That $1,000 deductible, on the other hand, is a one-time fee. You’ll have to fork it over in full before the insurance company will pay to repair or replace your car.

If a bigger deductible would take a toll on your wallet (and potentially leave you without transportation), then it makes sense to pay a little more each year and protect yourself in the event that you have to file a claim.

4. Forget the idea of a ‘cheaper’ time to insure

You may have heard that it’s cheapest to buy car insurance during a certain month or season. One 2013 study by InsuranceQuotes.com found that in some states, premiums were “up to 48% cheaper in December” — a stat that has since been cited in various news outlets claiming to have the ultimate savings trick.

While the trends that this study uncovered hold true to some extent, their scope is limited. Your own prices will vary depending on your age, driving record, vehicle, and other factors, so the likelihood of InsuranceQuotes.com’s results reflecting your own experience is fairly low (unless you happen to be “a 35-year-old single male driver with a $500 deductible and a clean driving record” — the profile used in this particular study).

In reality, the best time to buy car insurance is when you purchase a new vehicle or when your current policy expires. It’s important to be insured right away. Not only is it impossible to know when an accident might occur, but waiting for the “ideal” time to buy will jack your up rates. Car insurance companies penalize customers for having a gap between policies; if you’ve been uninsured for a period of time before renewing, you’ll be listed as “high-risk” and end up paying significantly more than you would have otherwise.

Pro tip: Instead of searching for the “cheapest” month, shop around before your policy expires. Many companies will cut you a discount between 3% and 10% for getting a quote or signing on before your renewal date.

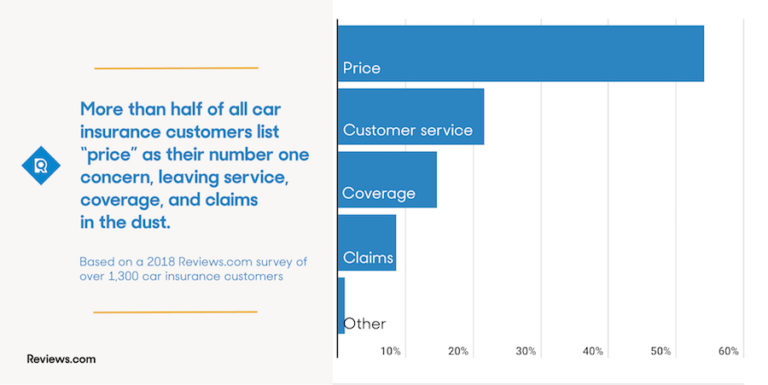

5. Don’t let price be your only consideration

Price is likely to be the deciding factor between any two companies with similar coverage. However, it shouldn’t be the only thing you consider when comparing insurers. There’s a lot to be said for companies with a strong customer service record and good claims handling, too.

“You can buy cheap insurance anywhere” says John Espenschied, Agency principal and owner of Insurance Brokers Group. “But if you find out that the provider isn’t able to adequately handle your claim, you might be disappointed in the settlement if and when you need to use your insurance.”

Before committing to an insurer based on price alone, check out its track record. You can vet customer satisfaction through Consumer Reports’ auto insurance survey and find claims handling scores at J.D. Power. If a company’s ratings make you squirm, it’s worth looking into other options. Service may mean the difference between a smooth, easy claims payout and a paperwork nightmare that only adds to the stress of an accident.

Pro tip: Skip the legwork and check out our review of the best cheap auto insurance, where we’ve evaluated top providers based on service, claims satisfaction, coverage, discounts, and more.

The Bottom Line

When it comes to car insurance, some things are simply given: Younger drivers pay more than older drivers, risky drivers pay more than safe ones, and bare-bones policies cost less but also pay less after a disaster. As far as these tenets go, there’s no tricking the system.

Luckily, there are plenty of ways that you can save on your car insurance. For tips, tricks, and expert advice, see our other articles on this topic: