First things first, it’s against the law to drive without demonstrating financial responsibility for the possibility of an accident. In most states, auto insurance is mandatory proof of that financial responsibility. As of 2025, Virginia requires insurance for all drivers after eliminating its uninsured motor vehicle fee in 2024 (Virginia), while New Hampshire continues to operate under a financial-responsibility system rather than a universal insurance mandate (New Hampshire). If you drive in NH and are required to show proof after certain incidents, you can satisfy financial responsibility via an insurance policy or approved alternatives such as a surety bond or a deposit of money/securities per RSA 264:22, or—in limited cases—a certificate of self‑insurance; NH may also require an SR‑22 filing for a set period after certain violations (NH DMV; RSA 264:22; NH SR‑22). For a national snapshot of compulsory insurance status and proof rules, see IIHS.

If you’re financing your car, there’s also a fair chance your lender will require you to own auto insurance, too. We recommend researching your local laws, as the answers to the following questions will vary a lot depending on where you live. Helpful references include the AAA Digest of Motor Laws (state‑by‑state penalties and procedures) and IIHS compulsory insurance tables for current minimums and verification practices.

What happens when you’re in a car accident and don’t have car insurance?

Accidents happen, to even the safest of drivers, and auto insurance is there to protect when they do — without it, you could end up owing much more than the cost of an annual premium. After an uninsured crash, future premiums often jump because insurers rate multiple risk factors at once: an at‑fault accident surcharge commonly around 40%–60%, a citation for driving without insurance that can add roughly 20%–40%+, and a lapse‑in‑coverage penalty that can be about 25%–35% for lapses over ~30 days; many drivers also need an SR‑22/FR‑44 filing for about three years, which keeps them in higher‑risk pricing tiers (The Zebra; ValuePenguin; Bankrate; coverage lapse impacts; VA SR‑22/FR‑44; III on rising rates).

Even if the accident wasn’t your fault, you could face penalties for being uninsured — like fines and having your license and/or registration suspended. States have very specific dollar amounts and steps. A few examples: Florida can suspend your license and registration for up to three years until you show proof and pay $150 for a first suspension, $250 for a second, and $500 for subsequent events (FLHSMV). New York treats operating without insurance as a misdemeanor with fines typically $150–$1,500 and/or up to 15 days in jail, plus registration and license revocation in many cases (NY DMV). In Illinois, a first conviction carries at least a $500 fine and later violations at least $1,000; registration may be suspended and reinstatement requires a $100 fee and proof (often SR‑22 for three years) (IL SOS). Ohio typically imposes a 90‑day license suspension for a first offense, longer for repeats, with reinstatement fees of $100/$300/$600 and proof filings required (Ohio BMV). Pennsylvania lists a $300 fine and a three‑month registration suspension, with restoration steps spelled out by PennDOT (PennDOT). Many states also use electronic verification to detect lapses and may tow/impound vehicles for repeat offenses (AAA Digest).

If the accident was your fault, there’s a good chance you’ll be sued for damages. The other driver’s insurer may pay its policyholder and then seek reimbursement from you (subrogation). Expect administrative penalties as above and, in many states, an SR‑22 requirement for about three years after a no‑insurance conviction or lapse‑related suspension (SR‑22 basics; AAA Digest). Virginia and Florida use FR‑44 for certain alcohol‑related offenses, which can carry longer filing periods and higher liability limits (VA FR‑44/SR‑22).

If the other driver caused the accident and you don’t have insurance, you could be limited on the compensation you receive per a “no pay, no play” law some states enforce. Louisiana reduces an uninsured claimant’s recovery by the first $15,000 of bodily injury and $25,000 of property damage (La. R.S. 32:866), several states bar noneconomic (pain‑and‑suffering) damages for uninsured owners/operators (e.g., CA Civ. Code § 3333.4; MO § 303.390; ORS 31.715), and New Jersey imposes a near‑total bar on recovery for uninsured owners/operators (N.J.S.A. 39:6A‑4.5(a)). For a current multi‑state summary, see NCSL.

The Consumer Federation of America compiled a historical survey; for up‑to‑date, state‑specific penalties, suspension lengths, reinstatement fees, and SR‑22 rules, use the AAA Digest of Motor Laws and cross‑check minimum coverage and proof requirements via IIHS.

What if the other driver doesn’t have car insurance?

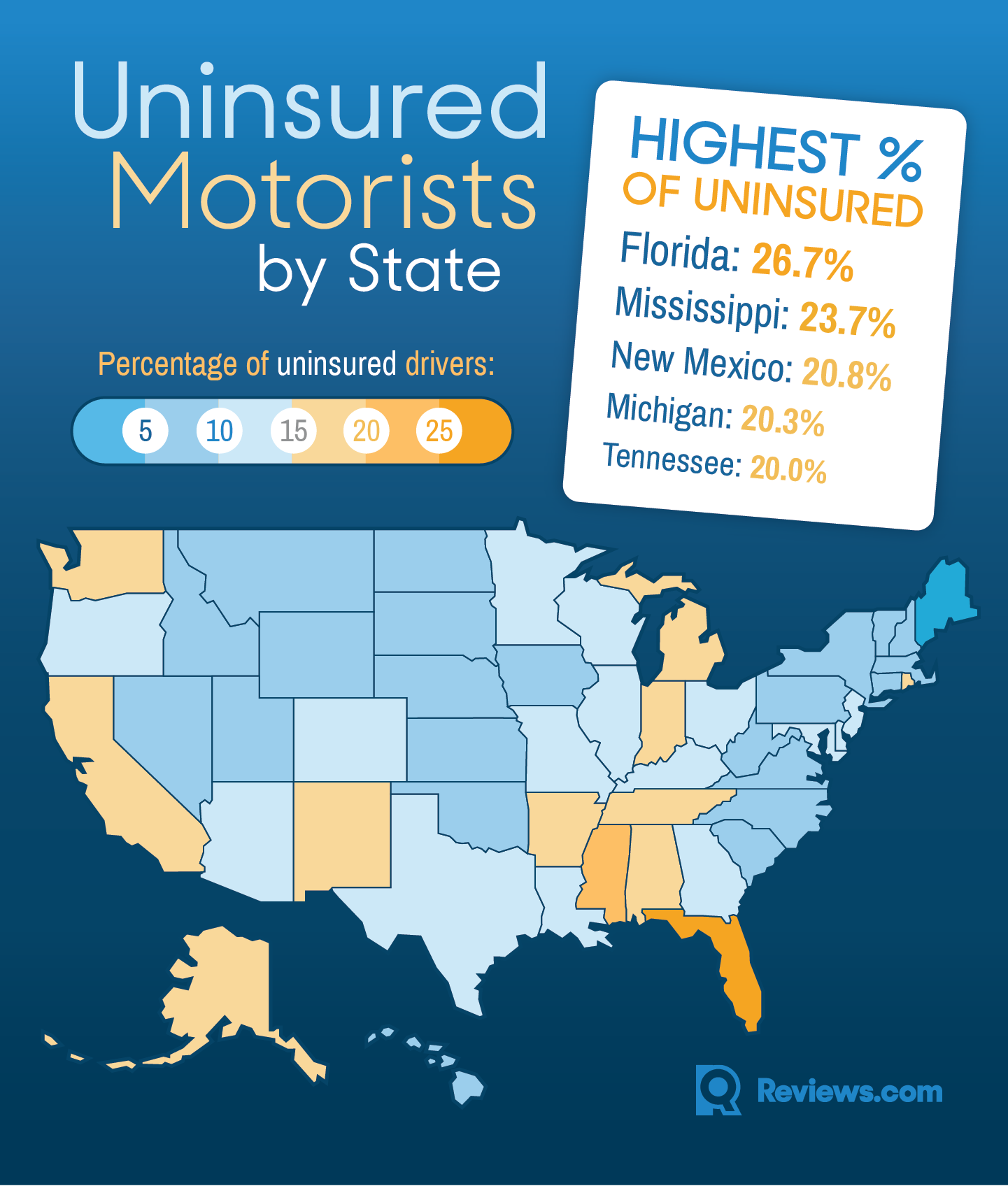

In 2022, the Insurance Research Council (IRC) found that 14.0% of U.S. drivers were uninsured—nearly 1 in 7. Rates vary widely by state: some Northeastern states are in the low single digits, while high‑UM states approach roughly 30% of drivers; recent summaries highlight Mississippi near the top and New Jersey/Massachusetts among the lowest (IRC 2017–2022; III blog; III facts; Insurance Journal). While you can sue the uninsured at‑fault driver, recovery is often limited if they lack assets.

If you have uninsured motorist coverage, then your insurance will cover the bill. This optional coverage is almost always sold separately (and is required or specially structured in some states) and can cover medical bills, lost wages, and—where available—property damage after an accident with an uninsured motorist. Practical tips for 2025: align UM/UIM limits with your bodily injury liability limits; consider stacking where allowed (e.g., Pennsylvania permits stacking by default unless you sign a waiver; see 75 Pa.C.S. § 1738); in New York, SUM is designed to match your BI limits unless you choose lower (III on UM/UIM); for property damage, some states offer UMPD or alternatives like California’s Collision Deductible Waiver when the at‑fault driver is uninsured (CA DOI CDW). Many states require prompt police reports for hit‑and‑run claims, especially for UMPD—Texas consumer guidance is a good example (Texas DOI). Given persistent hit‑and‑run risk documented by safety researchers, carrying robust UM/UIM remains high‑value protection (AAA Foundation).