First things first, it’s against the law to drive without demonstrating financial responsibility for the possibility of an accident. In most states, auto insurance is mandatory proof of that financial responsibility. In the few states that don’t require car insurance (New Hampshire and Virginia), you’ll need to prove that you have sufficient funds and will still be responsible for damages.

If you’re financing your car, there’s also a fair chance your lender will require you to own auto insurance, too. We recommend researching your local laws, as the answers to the following questions will vary a lot depending on where you live.

What happens when you’re in a car accident and don’t have car insurance?

Accidents happen, to even the safest of drivers, and auto insurance is there to protect when they do — without it, you could end up owing much more than the cost of an annual premium.

Even if the accident wasn’t your fault, you could face penalties for being uninsured — like fines and having your license and/or registration suspended. Monetary penalties will vary by state but could be anywhere from $25 to $5,000. A police officer could also decide to tow your car, and you’d then face impound fees, too. Basically, you could end up paying more by being uninsured than it would cost to purchase a policy.

If the accident was your fault, there’s a good chance you’ll be sued for damages. In most cases, the other driver’s insurance will reimburse them if you don’t have insurance. Sometimes you’ll be required to pay the other party’s deductible. And of course, you’ll face the same fees and penalties we mentioned above.

If the other driver caused the accident and you don’t have insurance, you could be limited on the compensation you receive per a “no pay, no play” law some states enforce. In Louisiana, for example, uninsured drivers (regardless of fault) will receive no compensation after an accident.

The Consumer Federation of America compiled a state-by-state breakdown of the penalties for driving without auto insurance, where you can read more about circumstances specific to where you live.

What if the other driver doesn’t have car insurance?

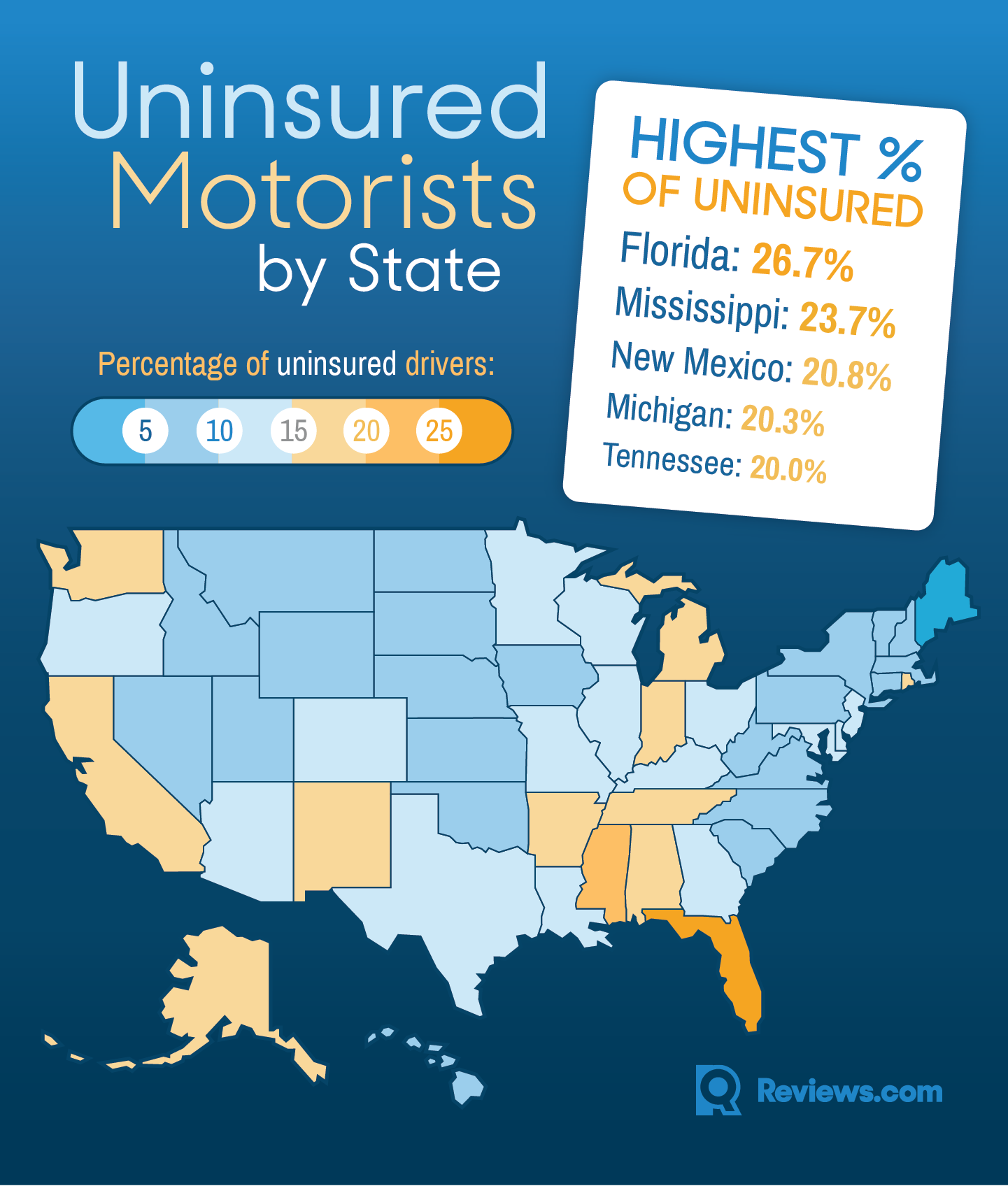

In 2017, the Insurance Research Council (IRC) found that one in eight drivers was uninsured, meaning there’s a fair chance you could be in a collision with an uninsured driver. Especially because the average cost of an uninsured motorist collision is around $20,000. While you can sue the uninsured at-fault driver, you won’t receive anything if they simply don’t have the money to cover the damages.

If you have uninsured motorist coverage, then your insurance will cover the bill. This optional coverage is almost always sold separately, but is a worthwhile add-on to your auto insurance policy. It covers medical bills, lost wages, and repairs that are a result of an accident with an uninsured motorist. Those that live in a state with a higher percentage of uninsured motorists, like Florida, will benefit from this additional protection.