If you sideswipe a parked car, cause a fender bender, or find yourself at-fault in a more serious collision, your insurance company will cover the other person’s injuries and damages. That’s what liability insurance is for. Conversely, if someone else were to hit you, their insurance company would be the one footing the bill.

But what if you’re on the receiving end of a collision and the other driver doesn’t have enough insurance to cover your damages? Or worse, doesn’t carry any insurance at all? Those situations are where your uninsured/underinsured motorist coverage comes into play.

What is Uninsured Motorist Coverage?

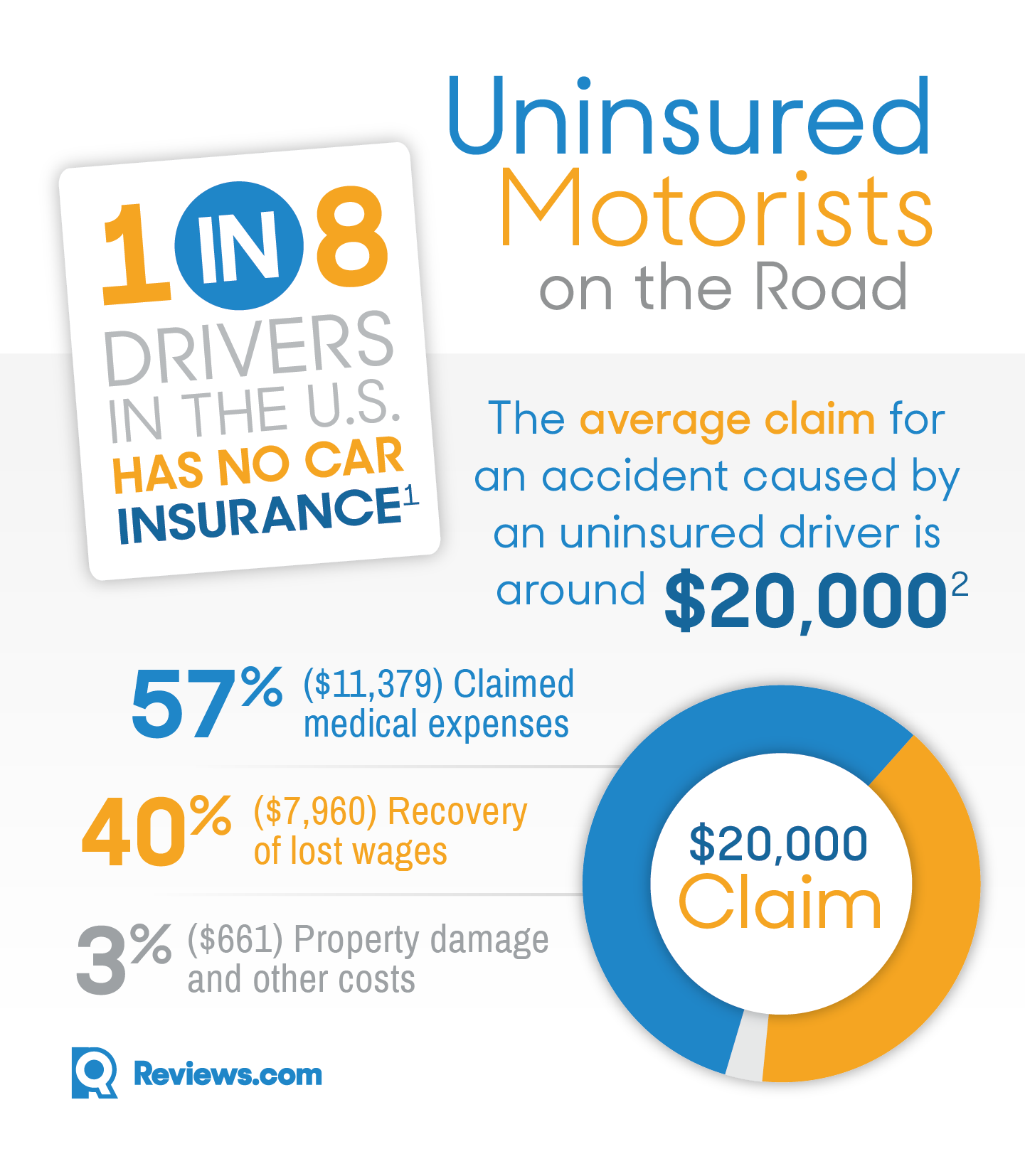

Uninsured motorist coverage (UM) protects you if you’re hit by a driver who doesn’t carry insurance. It can also cover you in a hit-and-run. With UM, your own insurer will pay for medical bills, lost wages, and property damages caused by an uninsured motorist, up to your policy limits. Without it, you could end up paying those costs out-of-pocket — which is no small consideration, given that the average cost of a UM collision is around $20,000.

¹According to the most recent data from the Insurance Research Council (IRC)

²According to the Hanover Insurance Group and the IRC

What Does Uninsured Motorist Insurance Cover?

Like liability insurance, uninsured motorist coverage can be broken down into two parts:

Uninsured motorist bodily injury (UMBI) pays for your or your passengers’ medical bills and lost wages if anyone is injured in a collision with an uninsured motorist.

Uninsured motorist property damage (UMPD) pays for repairs to your vehicle if it’s damaged by an uninsured motorist.

Unlike liability insurance, the two components of UM coverage are often sold separately. In fact, many of the states that require drivers to purchase UM only mandate UMBI coverage, and leave the decision of whether to purchase UMPD up to drivers. If you drive a newer or luxury vehicle that would cost a lot to repair or replace, we recommend looking into UMPD.

Uninsured vs. Underinsured Motorist Coverage

Uninsured (UM) and underinsured motorist (UIM) coverage are often talked about in the same breath. You may even see them grouped as UM/UIM, but they’re actually two separate coverages. UIM kicks in if a driver who hits you has insurance, but their liability limits are too low to fully cover your damages. This is especially important in states with low liability limits, where minimum coverage would likely fall short of total expenses after a serious collision.

UIM laws, like UM laws, vary by state. Many of the states that require UM also require UIM in equal amounts, while some only require UIM if your liability limits are above the state minimum. Though UM and UIM are separate coverages, they may be sold as a combined product. Ask your car insurance agent about UIM coverage requirements and cost if you’re purchasing UM.

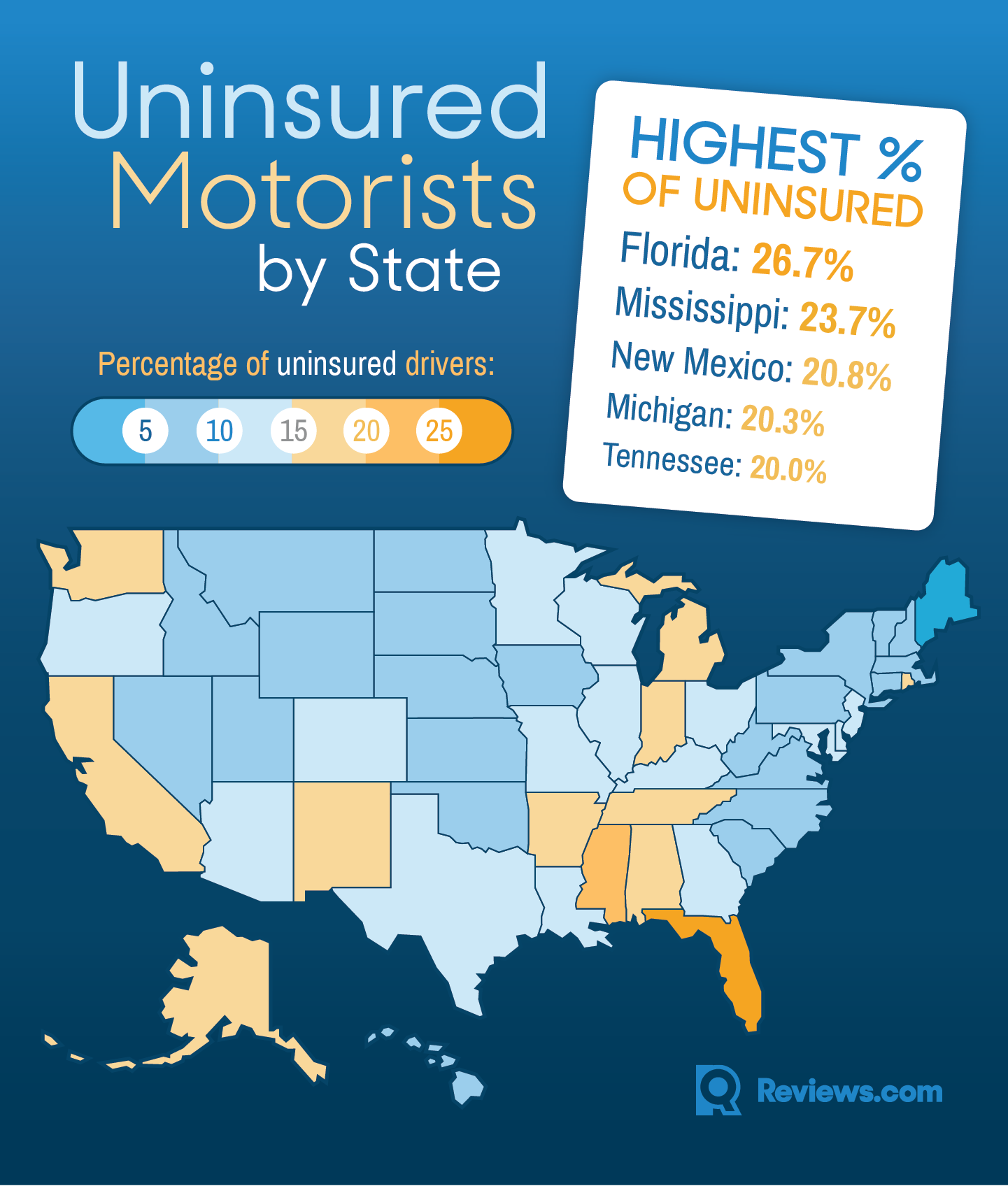

Data from IRC

How Much Does Uninsured/Underinsured Motorist Coverage Cost?

Uninsured and underinsured motorist coverage are relatively affordable. According to a 2019 rate analysis from CarInsurance.com, adding UM to your policy costs about $30–70 per year on average, and UIM costs around $15–45. That means adding both coverages would likely cause a $5–15 uptick on your monthly car insurance bill.

Is Uninsured Motorist Coverage Required?

We recommend carrying uninsured/underinsured motorist coverage, as the extra $5–15 on your monthly premium is a relatively small price to pay for added financial security. For some, it won’t even be a judgement call, as laws in at least 20 states actually require all drivers to carry these coverages. Those states set minimum coverage requirements for UM/UIM, just like with liability insurance.

| Minimum UMBI Coverage | Minimum UMPD Coverage | |

| Connecticut | 25/50 | |

| Washington, D.C. | 25/50 | 5 |

| Illinois | 25/50 | |

| Kansas | 25/50 | |

| Maine | 50/100 | |

| Maryland | 30/60 | 15 |

| Massachusetts | 20/40 | |

| Minnesota | 25/50 | |

| Missouri | 25/50 | |

| Nebraska | 25/50 | |

| New York | 25/50 | |

| North Carolina | 30/60 | 25 |

| North Dakota | 25/50 | |

| Oregon | 25/50 | |

| South Carolina | 25/50 | 25 |

| South Dakota | 25/50 | |

| Vermont | 50/100 | 10 |

| Virginia | 25/50 | 20 |

| West Virginia | 25/50 | 25 |

| Wisconsin | 25/50 |

Learn More About Your Auto Insurance

How to read auto insurance coverage levels

Uninsured/underinsured motorist levels, like liability insurance, are often written in shorthand. They follow the formula:

Bodily injury per person / bodily injury per accident / property damage per accident

Since UM insurance doesn’t always include property damage, it’s often broken down to only include bodily injury. So, for example, a UM coverage level set at “25/50” means your insurer would cover bodily injuries caused to you and your passengers by an uninsured motorist up to $25,000 per person, or $50,000 total per accident. Similarly, a property damage requirement of “15” means your insurer would pay for up to $15,000 of personal property damaged by an uninsured motorist per accident.