When Life Gives You Lemons…

Having to pay for homeowners insurance month after month leaves a sour taste in most people’s mouths. Lemonade, an app-based homeowners and renters insurance company, aims to make the experience faster and simpler with an all-digital flow and headline entry prices that stand out in certain lines: renters from $5/month and pet from $10/month. Actual premiums for homeowners and auto vary widely by state and risk in today’s market, where many carriers have taken sizable rate increases and motor-vehicle insurance inflation has remained unusually high into 2025 according to pricing indexes and the BLS CPI releases. On day-to-day usability, customer ratings signal a strong digital experience: the Lemonade app is rated around 4.9/5 on iOS and about 4.7/5 on Android, with broadly positive Trustpilot reviews for ease and speed, even as complaints—like most insurers—cluster on BBB escalation channels App Store Google Play Trustpilot BBB.

Read our full review of Lemonade Insurance

Who Is Lemonade Insurance For?

Lemonade’s sweet spot is digitally engaged customers—often renters and first-time homeowners—with straightforward coverage needs who prefer quoting, buying, and managing policies in an app. The company’s price signal is strongest in renters (from $5/month) versus a U.S. average of roughly $170–$180 per year (~$14–$15/month) per ValuePenguin. Pet policies also advertise a low entry point (from $10/month), though comprehensive accident & illness plans typically align closer to industry averages reported by NAPHIA (dogs ~ mid-$50s/month; cats ~ low-$30s/month) NAPHIA. For drivers in states where Lemonade Car is available, app-native telematics and usage-based pricing mean low-mileage and safer drivers may see more competitive quotes, while market-wide auto inflation continues to pressure premiums BLS CPI and has driven record shopping activity across the industry J.D. Power.

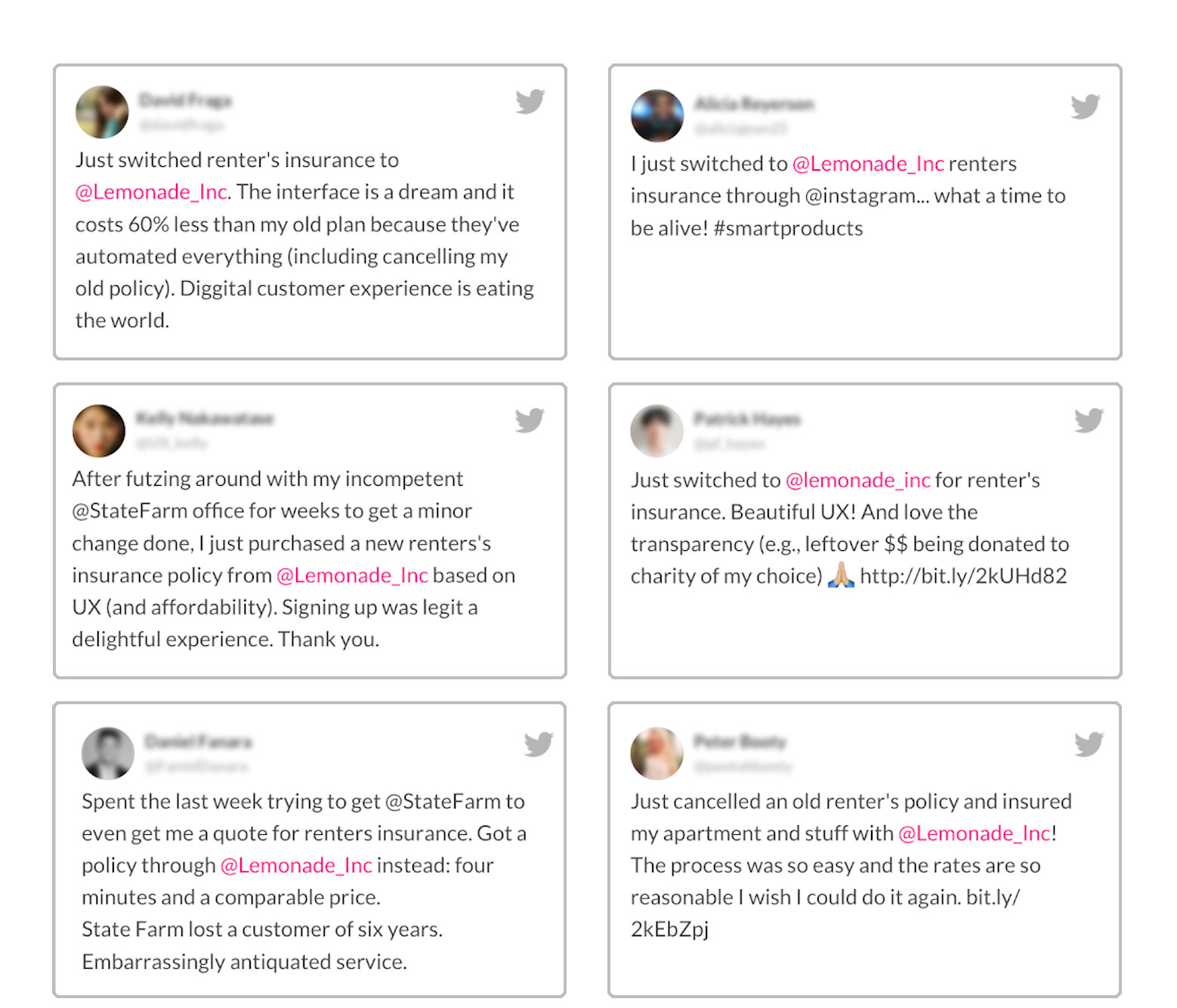

“As a [real estate] agent, I have been extremely satisfied with Lemonade’s insurance offerings, especially when it comes to tenants obtaining insurance,” says Jennifer Okhovat, a Realtor at Compass in Los Angeles, California. “Many landlords now require tenants to carry renters insurance, and Lemonade makes it quick and easy for tenants to sign up for a policy within minutes.”

Image: Twitter via Lemonade

Of course, Lemonade isn’t the right choice for all homeowners and renters. Rate competitiveness depends on your state, coverage limits, home value, and local risk—especially in catastrophe-exposed regions where many carriers (not just Lemonade) pursued double-digit homeowners rate increases through 2024 and into 2025 per Policygenius’ index. In auto, motor-vehicle insurance inflation has remained elevated, so realized pricing depends heavily on driver profile and telematics-driven discounts BLS CPI. That’s why it pays to compare quotes even if you prefer a digital-first carrier.

For example, Nick Haschka, Founder and COO of Credit Parent, says, “I shopped for Lemonade a few months back. Their quote process was slick. It was fast and easy to get a price, but their pricing was 35% above what I was paying with AAA of Northern California for a higher deductible and less overall coverage, so I stayed put.”

Finding the right homeowners insurance company for you means checking coverage options and comparing quotes from multiple insurers. As context, renters policies nationally average roughly $170–$180 per year (ValuePenguin), while homeowners premiums commonly land in the low-to-mid $2,000s—and higher in catastrophe-prone areas—amid recent, broad-based rate hikes Policygenius. If Lemonade offers you the best blend of price, coverage, and digital convenience, it can be a great fit; otherwise, shop wider.

How Lemonade Insurance Works

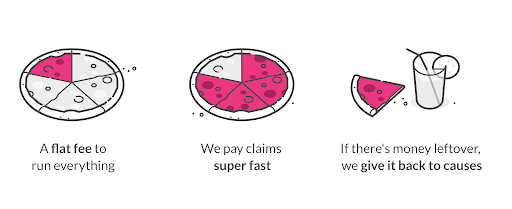

At its core, Lemonade pays covered claims for your home and belongings—similar to any insurer. What differs is its AI-first, direct-to-consumer operating model and Public Benefit Corporation structure. Lemonade describes a fixed-fee approach where premiums fund claims and reinsurance, the company retains a set fee to run the business, and any excess in cause-based customer cohorts may be donated via its Giveback program (not guaranteed and varies by cohort and year) Form 10‑K Giveback 2025. Policies can add extra coverage for valuables, and renters/homeowners include the standard perils and liability typical of the market.

Lemonade operates differently than a “normal” insurer in how it blends a fixed-fee model with Giveback and an automation-heavy stack. While customers don’t literally insure one another, cohorts are grouped by the nonprofit cause selected at signup; when claims and expenses come in lower than expected for a cohort, Lemonade may donate remaining funds to that cause—again, variable by year and not a fixed share of premiums Giveback 2024 Giveback 2025 10‑K.

It works like this: If you insure your home or apartment with Lemonade, your premium contributes to paying claims and reinsurance for your product and cohort. Lemonade takes a fixed fee, automates service and claims where possible, and—if there’s excess after claims and expenses in your cause cohort—may donate it via Giveback. The company emphasizes that Giveback outcomes vary with loss experience and are not guaranteed company disclosures.

Image: Lemonade

Part of the reason Lemonade’s model works is that it’s completely digitized. Lemonade doesn’t operate physical agencies; customers apply, buy, and file claims online or in the mobile app. That keeps overhead lean, enables straight‑through processing for simple claims, and supports low advertised entry prices in renters and pet ($5/month; $10/month), while homeowners and auto premiums remain highly state- and risk-dependent amid industry-wide increases Policygenius BLS. Industry research shows straight‑through handling for low-severity claims and instant pay are fast becoming table stakes for digital insurers Accenture Capgemini.

Many people will find Lemonade’s digital-first attitude refreshing. App store ratings around 4.9/5 on iOS and 4.7/5 on Android point to a smooth onboarding and servicing experience iOS Android. However, if you have complex coverage needs, want in‑person advice, or need hands-on bundling across multiple lines, a traditional agented carrier may fit better. Consumer research also shows pricing pressure has weighed on satisfaction in home insurance, so it’s wise to compare options at renewal even if you prefer a digital journey J.D. Power.

Lemonade’s Giveback Program

Lemonade’s Giveback is central to its Public Benefit Corporation and certified B Corp identity. Customers pick a nonprofit cause at signup; if a cause cohort has excess funds after claims, expenses, and reinsurance, Lemonade donates that excess annually. Recent Givebacks were about the low‑$2 million range in 2024 and the low‑to‑mid $2 million range in 2025, supporting roughly 60+ nonprofits each year; cumulatively, Giveback has now surpassed $10 million since launch Giveback 2024 Giveback 2025. B Lab, which certifies B Corporations, is evolving its standards from a points-only model toward defined topic-based requirements that B Corps will transition to over time—covering areas like stakeholder governance, climate action, DEI, and fair value for customers B Lab standards evolution B Corp performance requirements.

For customers, Giveback can make premiums feel more purposeful: what isn’t needed for claims, reinsurance, or Lemonade’s fixed fee in a cause cohort may go to that cohort’s nonprofit, though it is not guaranteed and varies with loss experience and portfolio mix company blog 10‑K.

“Giveback 2025 reports donations in the low–to–mid $2 million range to 60+ nonprofits, with cumulative Giveback since inception now above $10 million.”

Lemonade Giveback 2025

Company blog

Giveback has generally trended upward alongside scale, with around $2 million donated in 2024 and an increase in 2025. Importantly, Giveback is not a fixed percentage of premiums and depends on cohort-level outcomes, reinsurance, and weather—an approach Lemonade outlines in filings as part of its Public Benefit mandate 10‑K.

Giveback also increases transparency about where unclaimed funds go and reduces perceived conflicts over unpaid claims by separating Lemonade’s fixed fee from the pool used to pay claims. That said, Giveback outcomes can fluctuate year to year with loss experience and are not guaranteed Lemonade.

To be clear, we don’t mean to say that all other insurers are purposely withholding claims to increase profits. Lemonade’s model simply adds an additional layer of clarity. The company notes it seeks to pay valid claims quickly, while acknowledging that Giveback varies by cohort and year and is not a fixed share of premiums company disclosures.

Filing Claims with Lemonade

Speaking of claims, Lemonade has taken steps to digitize the homeowners insurance claims process. Many low‑severity claims can be initiated—and, when eligible, settled with instant payment—directly through the app using the company’s automation layer; complex claims route to licensed human adjusters Lemonade AI overview. This aligns with broader industry movement toward straight‑through processing for simple claims and AI‑assisted adjusters to cut cycle time and improve customer experience McKinsey.

If you’re having trouble imagining how a home insurance claim could be processed with AI, think triage, coverage checks, documentation ingestion, fraud screening, and—when confidence is high—instant settlement; otherwise, a human takes over. These capabilities are increasingly common across insurers, with genAI now used to summarize files and draft communications under human oversight industry research.

“AI Jim,” Lemonade’s automation agent, handles intake and adjudication steps for simple claims, and the company has publicly highlighted instant-pay examples—including a world‑record instant payment—while complex matters are handled by human adjusters. Recent SEC filings emphasize AI across FNOL, adjudication, and fraud controls but do not specify a current percentage of fully automated payments Lemonade AI 10‑K.

In other words, Lemonade blends automation with human expertise. Straight‑through settlements are great for simple claims, and licensed adjusters handle nuanced losses. Regulators are also sharpening expectations for responsible AI use in insurance, with the NAIC’s model bulletin and New York’s AI circular outlining governance, testing, and oversight for models used in underwriting and claims NAIC AI bulletin NY DFS Circular Letter No. 2 (2024).

Note: Claims can only be filed through Lemonade’s mobile app, not on the company’s website or over the phone. For this reason, Lemonade users must have a smartphone.

What’s Next?

- Read our full review of Lemonade Insurance

- Explore other top home insurance companies

- Learn how much home insurance you need