Since there’s no such thing as an overarching hurricane insurance policy, different parts of a hurricane loss are covered by different products. Wind and wind-driven rain that enter through a wind-damaged opening are typically handled by homeowners insurance (often with special wind/hurricane deductibles), while storm surge and other rising water are excluded and require separate flood insurance. FEMA’s Risk Rating 2.0 changed how National Flood Insurance Program (NFIP) premiums are calculated, but not what the NFIP covers. The legally controlling Standard Flood Insurance Policy still caps residential building coverage at $250,000 and contents at $100,000, excludes Additional Living Expenses (ALE), and sharply limits basement coverage (SFIP; CRS NFIP overview; NFIP covered items; NFIP exclusions). New NFIP policies generally have a 30‑day waiting period with limited exceptions (NFIP Flood Insurance Manual (2025)). Also note: home warranties are service contracts for wear-and-tear and generally exclude damage from natural disasters, so they are not a substitute for insurance (FTC).

Who covers what damage?

Coverage depends on the cause of loss. Homeowners insurance typically covers wind damage to the roof, siding, and interior when rain enters through a wind-damaged opening, including Loss of Use/ALE if the home is uninhabitable due to a covered peril (homeowners basics; NAIC homeowners guide). Flood from storm surge, overflow of inland or tidal waters, or rapid accumulation/runoff of surface water is excluded by homeowners policies and requires a flood policy; storm surge is considered flood (NFIP coverage; NFIP exclusions; Triple‑I flood overview). If a sewer backup is a direct result of a flood, NFIP may cover it; otherwise it generally requires a separate homeowners water‑backup endorsement, not standard flood or HO policies (NFIP exclusions). Private flood insurers may offer higher limits than NFIP, optional ALE, different basement treatment, and shorter waiting periods, but terms vary and lender acceptance must be confirmed (NAIC flood consumer resource).

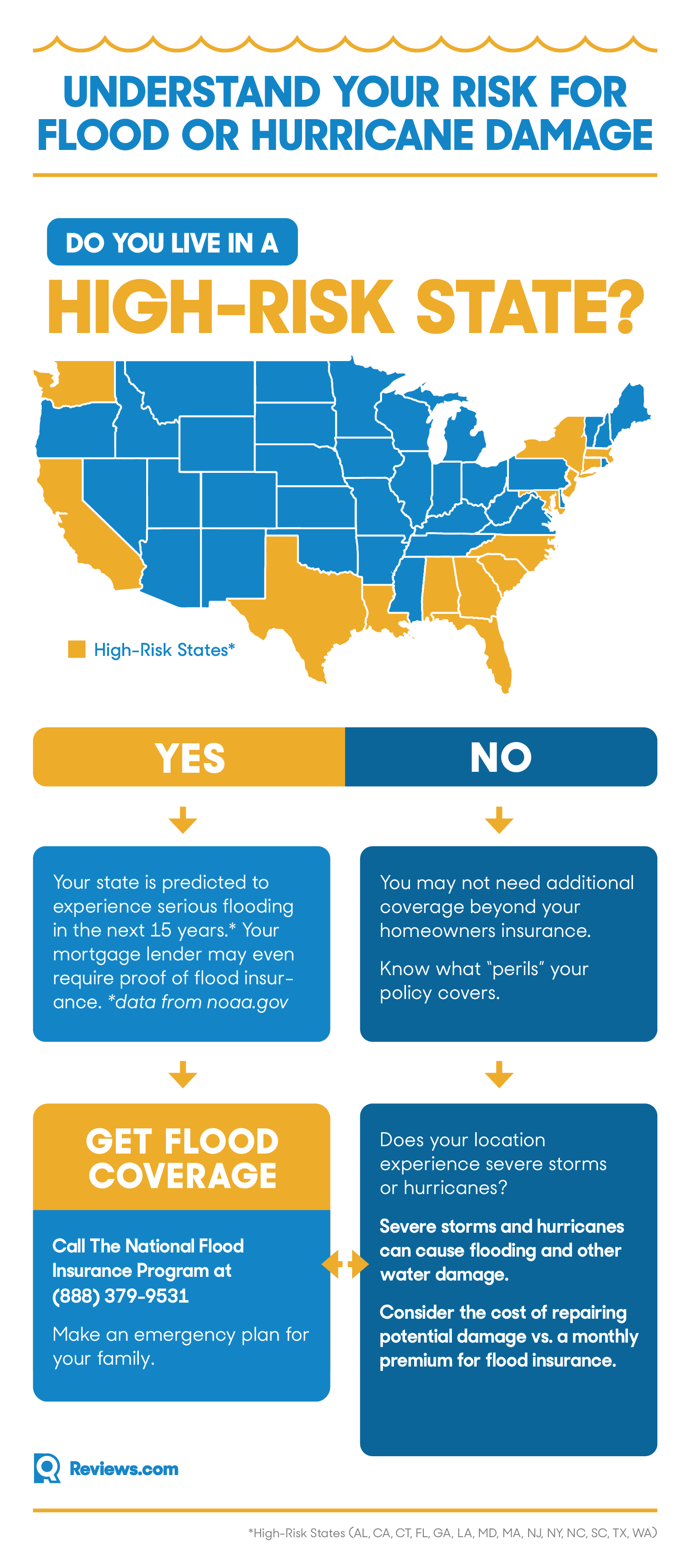

To break it down, we made a handy graphic to help you navigate what coverage you need and, in the event of damage, which provider you’ll need to contact to file a claim. Keep timing and lender rules in mind: most new NFIP policies have a 30‑day waiting period (NFIP manual). If any building securing your mortgage is in a FEMA Special Flood Hazard Area (SFHA), your lender must require flood insurance, and many conventional loans will accept eligible private flood policies that meet investor standards (Interagency Q&As; Freddie Mac). In Florida, Citizens Property Insurance Corporation is phasing in a flood insurance requirement for many personal residential policies even outside mapped high‑risk zones (Citizens flood requirement).

Do I need flood insurance?

Start with a property‑level risk review rather than a simple “in/out of the flood zone” check. Under Risk Rating 2.0, NFIP premiums are based on address‑specific factors like distance to water, multiple flood types (riverine, coastal, rainfall‑driven), foundation type, first‑floor height, and replacement cost; flood maps still govern mandatory purchase rules but are no longer the primary basis for pricing (NFIP manual (2025)). Modern risk assessments (NFIP and private) also use probabilistic modeling that produces average annual loss (AAL) and exceedance‑probability curves, helping you size limits and deductibles (U.S. flood model overview). To understand local hazards beyond firm lines on a map, pair official FIRMs with tools like NOAA Atlas 14 for extreme rainfall, USGS Flood Inundation Maps for expected river depths, and the NOAA Sea Level Rise Viewer for long‑term coastal water levels.

Why consider flood insurance even outside mapped SFHAs? A warmer atmosphere holds more moisture, so hurricane rainfall rates are projected to increase by roughly ~7% per °C, raising freshwater flood risk; sea‑level rise also amplifies storm surge for a given storm, increasing coastal flood severity (NOAA GFDL). Recent seasons highlighted this potential: Hurricane Beryl became the earliest Atlantic Category 5 on record in 2024, underscoring how very warm oceans can support intense storms when conditions align (NHC Beryl report; WMO State of the Global Climate). Despite these risks, FEMA data show flood insurance uptake remains low—about 30% inside SFHAs and only about 1–2% outside them—while total NFIP policies hover around roughly 4.6–4.8 million (FEMA take‑up rates; NFIP policy counts). The private flood market now accounts for roughly one‑third of U.S. flood premium, often providing higher limits and optional ALE that NFIP lacks (NAIC flood market report).

The great debate among homeowners – do you need flood insurance? It’s best to do a risk analysis of your home with your insurance agent to estimate the likelihood of flood damage to your home. Things like your exact location and the condition of your home will impact the need for additional insurance. There are certain areas where flood insurance is definitely recommended, and others where it is commonly a requirement from mortgage lenders. Check this graph to understand how necessary flood insurance may be for your home.