“No-exam life insurance” generally refers to pathways that waive lab work and a paramedical exam while still delivering a fast decision. In 2025, many carriers use accelerated underwriting to make instant or near‑instant decisions for eligible applicants by analyzing electronic data (e.g., prescription history, MVR, MIB, and increasingly electronic health records), so coverage can start quickly without a physical for those who qualify. Policygenius and NerdWallet explain how these no‑exam options work and when they make sense.

“About half of U.S. adults have life insurance, and many prefer simpler, faster buying experiences — including no‑exam options — when shopping for coverage.”

LIMRA & Life Happens

2018 Life Insurance Barometer study

There is a trade-off: Pricing depends on which “no‑exam” path you choose. For healthy non‑smokers who qualify for accelerated underwriting, premiums often match the insurer’s fully underwritten rates at the same class. By contrast, simplified‑issue term (also no exam) typically costs about 30%–80% more than accelerated/fully underwritten for comparable profiles, reflecting broader acceptance criteria. Typical 2025 quotes for healthy non‑smokers on $500,000 of 20‑year term are about $18–28/month (age 30 men) and $15–25 (age 30 women); $30–45 (age 40 men) and $25–38 (age 40 women); and $70–110 (age 50 men) and $55–85 (age 50 women). For $1,000,000 at age 30, quotes commonly cluster around $30–50/month (men) and $26–42 (women). See current rate tables and methodology from Policygenius and their no‑exam overview here, plus corroborating ranges in NerdWallet’s guide.

Coverage ceilings vary by pathway. Many accelerated underwriting programs list maximums around $3–$5 million, and select direct‑to‑consumer platforms are higher (for example, Ladder cites $100,000 to $8,000,000; Haven Life lists up to $3,000,000; John Hancock ExpressTrack also notes up to $3,000,000). Simplified‑issue term commonly tops out around $1–$1.5 million (e.g., Bestow up to $1.5 million). Guaranteed‑issue whole life is intended for final‑expense needs with small face amounts, typically about $2,000–$25,000, and usually includes a graded death benefit for the first two years (Mutual of Omaha). A few disruptors and large carriers are expanding eligibility, but if you need very large coverage, you may be routed to full underwriting.

| Health Rating | Price Increase Range | Average Price Increase |

|---|---|---|

| Preferred Plus Non-Smoker | Generally lower than Standard; varies by carrier | Not universal; pricing reflects lower mortality in SOA 2015 VBT |

| Preferred Non-Smoker | Lower than Standard; varies by carrier | Not universal; class differentials vary with age/sex/product |

| Standard Plus Non-Smoker | Slightly lower than Standard; varies by carrier | Not universal; depends on carrier rate classes |

| Standard Non-Smoker | Baseline for comparison | Baseline (100% of Standard premium) |

| Preferred Smoker | Higher than nonsmoker classes; varies by carrier | Not universal; smoker mortality priced higher |

| Standard Smoker | Higher than Standard Non‑Smoker; varies by carrier | Not universal; smoker mortality priced higher |

Notes on pricing by class: Carriers use preferred/standard classes with distinct mortality expectations documented in the SOA 2015 VBT; exact premium differences versus Standard vary by age, sex, product, and company. When applicants do not qualify for Standard, substandard “table ratings” typically add +25% of the Standard premium per table step (e.g., Table B/2 = +50%) per carrier education materials from Legal & General America and Protective. Current sample quote ranges and no‑exam context are available from Policygenius. Legacy sample comparison: Simple Life Insure (for illustration only; consult current carrier quotes).

Good Reasons to Look Into No-Exam Insurance

Despite pricing and coverage differences, a no‑exam pathway can be the best fit in specific cases — especially when speed and convenience matter and your coverage need aligns with program limits.

- If you want coverage fast, accelerated underwriting can deliver same‑day to a few‑day decisions for many eligible applicants by using electronic data instead of labs; if more evidence is needed, your case can route to a traditional exam. See program positioning from Haven Life (up to $3M, many qualify without an exam) and John Hancock ExpressTrack (up to $3M, lab‑free for qualifying risks), and broader context in Policygenius.

- If you need modest coverage and simple screening, simplified‑issue term uses a short health questionnaire and data checks (no labs) for quick decisions, with typical maximums around $1–$1.5 million (e.g., Bestow up to $1.5M). Expect higher premiums than accelerated/fully underwritten for the same profile.

- If you have significant health issues or prior declines, guaranteed‑issue whole life accepts eligible ages with no health questions or exam, usually for small amounts (about $2,000–$25,000) and a two‑year graded death benefit before the full face amount is available. Example: Mutual of Omaha.

- If you prefer to avoid needles and lab work, a no‑exam path can remove friction. For healthy applicants, accelerated underwriting can still deliver fully underwritten‑level pricing without fluids; see rate context in current quote tables.

- If timing or documentation is a constraint (e.g., closing on a loan or satisfying a court requirement), no‑exam options can reduce cycle time by avoiding APS retrieval and lab scheduling; industry modernization trends are expanding these pathways through better data and workflow orchestration (TEFCA live; MIB–Health Gorilla EHR collaboration).

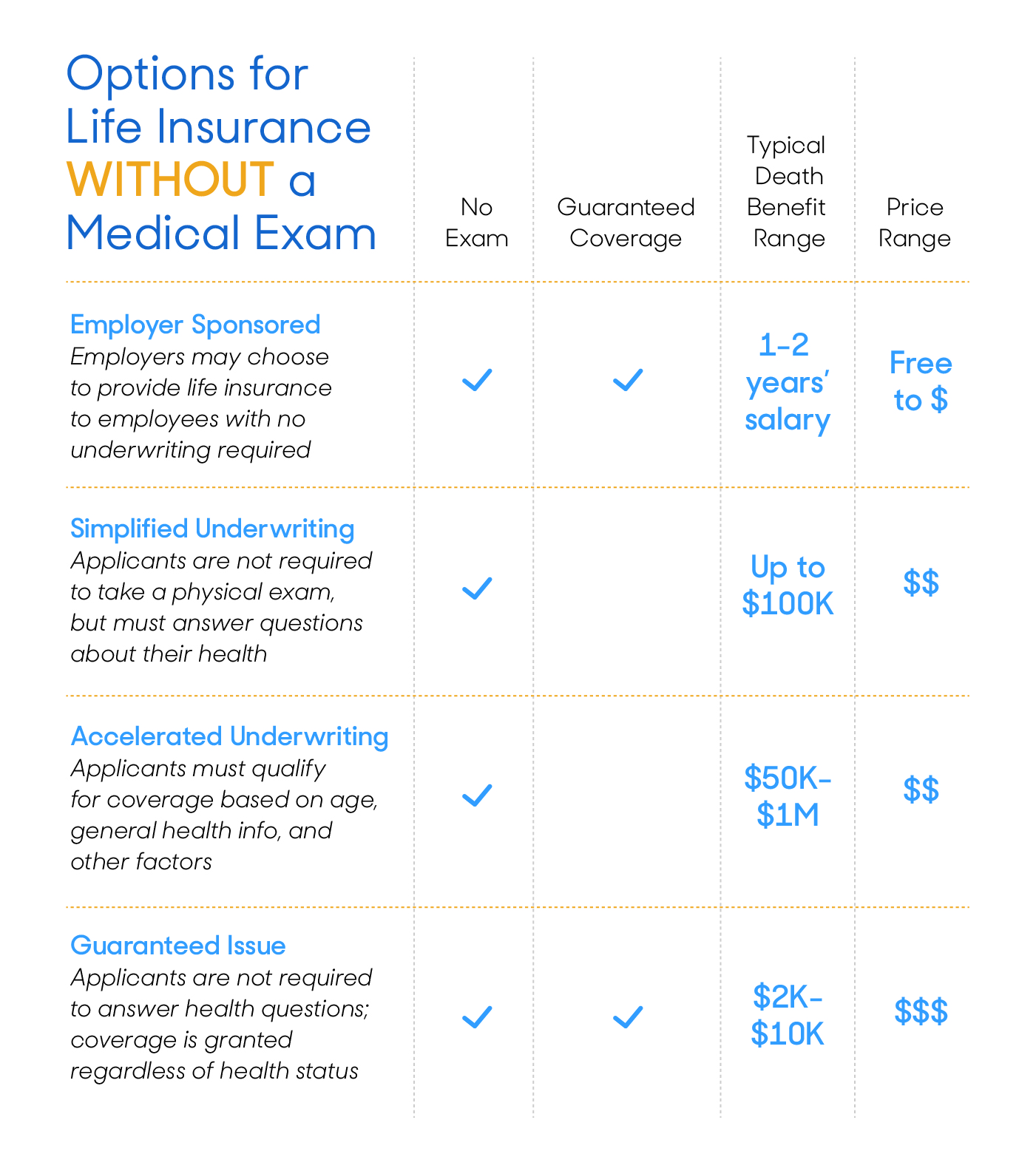

Options for No-Exam Life Insurance

No‑exam life insurance commonly appears as “accelerated underwriting,” “simplified issue,” or “guaranteed issue.” All waive the medical exam but differ in evidence, price, and limits. Accelerated underwriting is a pathway within a fully underwritten product that uses electronic data to waive labs for eligible, lower‑risk applicants; pricing typically matches fully underwritten at the same class, and decisions are often days or faster. Simplified issue asks a short health questionnaire plus data checks and offers quick decisions with higher cost per dollar than accelerated/fully underwritten. Guaranteed issue asks no health questions and offers small face amounts with a graded benefit, making it the costliest per dollar and a last‑resort safety net. See the NAIC’s consumer overview of life insurance basics here and side‑by‑side product examples in carrier materials (Pacific Life PL Swift; Lincoln TermAccel).

Employer-sponsored life insurance is a great start if your workplace offers it, but death benefits are generally minimal relative to family needs. Many people rely solely on group coverage and remain underinsured; an individual term life policy can supplement employer benefits to better match income replacement and debt protection goals (Insurance Barometer Study).

If you’re healthy and shopping for no‑exam coverage outside of work, start with accelerated underwriting from reputable carriers or platforms. Many programs allow $3–$5 million (e.g., Haven Life up to $3M; John Hancock ExpressTrack up to $3M; Ladder up to $8M) and can deliver fully underwritten‑level pricing without labs if you qualify.

Guaranteed issue should be considered a last‑resort option intended for final expenses. Expect small face amounts (about $2,000–$25,000) and a two‑year graded death benefit before full payout on natural causes; accidental death is often covered immediately. Compare costs carefully and confirm the waiting period (Mutual of Omaha Guaranteed Whole Life).

The No-Exam Life Insurance Game Is Changing

Historically, no‑exam policies were pricier due to less medical evidence. That’s shifting as underwriting modernizes. For many healthy applicants, accelerated underwriting can now match fully underwritten pricing while skipping labs by corroborating risk with third‑party data like Rx histories, MVR, MIB, and — increasingly — electronic health records accessed through nationwide exchange. The TEFCA network is live, and collaborations such as MIB–Health Gorilla are expanding EHR availability, improving hit rates and cycle times compared with traditional APS retrieval.

Insurers still charge more when they accept more uncertainty — which is why simplified‑issue policies usually cost more than accelerated or fully underwritten coverage. But when data are sufficient, accelerated underwriting lets carriers keep prices competitive without fluids, and decisions are increasingly same‑day to a few days for eligible cases (Pacific Life PL Swift; Lincoln TermAccel).

Underwriting tools are also evolving. Carriers are deploying practical GenAI to summarize medical records and support decisions while retaining human review and interpretable rules. Governance expectations are rising: the NAIC AI Model Bulletin and Colorado’s life‑insurance AI/algorithm rule set requirements for testing, monitoring, and vendor oversight that shape how accelerated programs expand.

The American Council of Life Insurers describes accelerated underwriting as “the use of new data sources to ‘categorically’ or ‘selectively’ waive fluids and other costly [underwriting] requirements.” In other words, replacing peeing in a cup with a digital background check.

Companies like John Hancock link wearable activity to rewards and potential premium savings through voluntary wellness programs; evidence shows such incentives can increase activity and are typically used for engagement rather than base‑rate pricing (RAND Europe study).

What exactly are the “new data sources” that insurers are tapping into? Carriers commonly review prescription histories, motor vehicle records, MIB reports, and, where available, electronic health records retrieved via FHIR APIs through intermediaries connected to TEFCA QHINs. These sources raise straight‑through processing when signals are consistent; otherwise, cases pivot to traditional evidence. See TEFCA’s activation here and the EHR expansion efforts here. For insurance history data, carriers also consult MIB.

Regulators are clarifying guardrails for data and algorithms used in underwriting and wellness programs. The Colorado Division of Insurance adopted rules requiring life insurers to govern and test AI/algorithms and external consumer data to prevent unfair discrimination, and the NAIC AI Model Bulletin sets national‑level expectations for transparency, testing, and vendor oversight.

All that sounds kind of complex — and it is — but the direction is clear: explainable decisioning, better data pipes, and stronger governance are enabling faster approvals without sacrificing appropriate risk controls. As these programs scale, expect continued balance between privacy, convenience, and price (Deloitte’s 2025 outlook).

The Bottom Line: If You’re in Good Health, It’s Still Worth It to Take the Exam

The industry is moving toward exam‑less underwriting, and many healthy applicants can now get fully underwritten‑level pricing without labs through accelerated programs. If the data indicate your case needs more evidence or you’re seeking higher face amounts beyond no‑exam eligibility, a traditional medical exam may still unlock the best rates and broader coverage options. Compare accelerated‑underwriting quotes first, and be prepared to pivot to full underwriting if needed (how no‑exam works; current rates).

Here’s What to Expect From a Life Insurance Medical Exam

Life insurers try to minimize hassle. A licensed professional typically comes to your home to complete the exam, so you won’t need to visit a clinic. If you qualify for accelerated underwriting, labs may be waived and decisions can be near‑instant; otherwise, plan for a standard paramedical visit.

The exam starts with a health questionnaire covering your medical and family history, medications, and lifestyle factors.

Next, the examiner collects fluid samples to verify your health status — a quick blood draw and urine sample. A strong aversion to needles is one reason some people choose a no‑exam option.

Most exams take about 30 minutes. If your case proceeds through full underwriting, expect a waiting period of a few weeks while lab results and any medical records are reviewed; accelerated pathways can shorten this to days or less for eligible applicants (NAIC consumer guidance).

Tips for the Best Results on Your Life Insurance Physical

Take these simple steps to make sure you’re putting your healthiest foot forward when it’s time for your life insurance physical:

- Detox for the week leading up to your exam. Cutting back on sodium and staying hydrated can help lower blood pressure and cholesterol levels.

- Fast for 8 to 12 hours before your exam. Eating before you get bloodwork done can alter your results and cause a poorer read on your liver function and glucose levels. Try to schedule your exam in the morning and eat right after.

- Stay away from physical extremes before your exam. Anything from alcohol and caffeine to overly strenuous exercise can skew your results. Keep it even-keel for the week preceding your exam to make sure that your health is accurately represented.

Learn more about how to shop for life insurance and prepare for your medical exam in our review of the term life.