Most drivers shop primarily on price, but the biggest and most reliable savings come from stacking widely available discounts and programs that major insurers still offer in 2025 — including multi-policy bundling, multi-vehicle, good/safe driver, defensive-driving, good student, vehicle safety/anti-theft, and administrative savings like pay-in-full, autopay, paperless, and online quote/signing. These are documented on current insurer discount pages such as Progressive, GEICO, State Farm, and Allstate. We also highlight newer and expanding options like usage‑based insurance (UBI) telematics programs recognized by the NAIC for potential savings tied to safer or lower‑mileage driving.

If you’re looking to save on cost and time, we’ve summarized the main points below; otherwise, keep reading for data-backed ways to lower your premium — including bundling strategies, early‑quote timing, state‑specific rules (like PIP/UM requirements), and whether telematics or accident-forgiveness programs make sense for you with your chosen carrier.

8 Tips for Cheap Car Insurance

While you’re shopping around, keep in mind that price isn’t all that matters when it comes to car insurance. It’s important to find a provider that offers the coverage you need (including unique options like lease payoff or rideshare coverage) and that also supports the discount types you can actually use: bundling/multi‑vehicle, safe‑driver, good student/driver training, vehicle safety/anti‑theft, and administrative savings like pay‑in‑full, autopay, paperless, and online quote/signing (see current listings from Progressive, State Farm, GEICO, and Allstate).

In addition, most states only require drivers to carry liability insurance — which protects others on the road, but won’t cover your own damages or medical bills if an accident occurs. Several states also mandate Personal Injury Protection (PIP) and/or Uninsured/Underinsured Motorist (UM/UIM). No‑fault/PIP states include FL, HI, KS, KY (choice), MA, MI, MN, NJ (choice), NY, ND, PA (choice), and UT. Recent changes raised liability minimums in major states: California moved to 30/60/15 effective 1/1/2025 (and will increase again in 2027), and Virginia increased to 50/100/25 effective 1/1/2025 and eliminated the uninsured motor vehicle fee to make insurance compulsory. See state-by-state minimums via the Insurance Information Institute, California Vehicle Code §16056, Code of Virginia §46.2-472, and Virginia DMV insurance requirements. Special frameworks remain in Florida ($10,000 PIP and $10,000 PDL; BI not generally mandatory) and New Hampshire (no universal mandate; see NH DMV).

Work with an insurance agent or online calculator to determine your insurance needs before checking prices. Verify any state‑specific requirements (e.g., whether PIP or UM/UIM is mandatory in your state), and confirm which discounts and programs are available where you live, since many are state‑regulated (for example, UBI and accident forgiveness can vary by state rules and filings).

1. Compare lots of quotes

The golden rule of cheap car insurance is “compare, compare, compare.” Prices can differ significantly across carriers for the same driver and coverage because each company’s rating model weighs factors differently. Where permitted by law, credit-based insurance scores (CBIS) also influence price; multiple analyses show large premium differences by credit tier, including a 2024 national study finding drivers with poor credit pay about 96% more on average than those with excellent credit (in states where credit is allowed). Some states ban credit in personal auto pricing — notably California, Hawaii, and Massachusetts — and others apply guardrails. Learn more from the NAIC’s consumer explainer on CBIS and the 2024 State of Auto Insurance study.

There’s no way to tell who will deem you “least risky” (and therefore cheapest to insure) ahead of time, so collect quotes from multiple companies to find the best fit for your profile and state rules.

2. Price out bundling discounts

Multi‑policy (“bundling” home/renters with auto) and multi‑vehicle savings remain among the largest recurring discounts in 2025, and they’re widely advertised by major carriers. Examples: Allstate, State Farm, and Progressive all promote multi‑policy and multi‑car savings. Some carriers also call out new car and hybrid/EV discounts where available (e.g., Travelers). Discounts often “stack,” but insurers may cap total savings or apply them only to certain coverages — so confirm how each discount is calculated in your quote.

3. Ask about specialty discounts

Your quote will automatically factor in most standard discounts (safe driver/claims‑free, defensive‑driving or driver‑training courses, good student, safety/anti‑theft equipment, pay‑in‑full, autopay, paperless, and online quote/sign). Some savings are easy to miss unless you ask: military/affinity and federal employee discounts (see GEICO), hybrid/electric‑vehicle savings in certain states (Travelers), and specialty military benefits like on‑base garaging or storage during deployment (USAA). Expect documentation (e.g., report cards, course certificates, proof of anti‑theft device), and remember availability varies by state.

For a full rundown of the discounts you should be looking for (and who offers them), see find a provider.

4. Drive safely and stay claim-free

Clean records are rewarded across carriers with safe‑driver/accident‑free discounts and, in many cases, additional savings when paired with telematics. If you already have a mark on your record, time matters — premiums often improve as violations/claims age off your history. Another option is accident forgiveness, which many carriers still offer in 2024–2025 either as an earned perk or an add‑on endorsement (availability varies by state, with common exclusions such as CA, CT, and MA). Examples: Progressive has Small Accident Forgiveness for minor claims and Large Accident Forgiveness after five accident‑ and violation‑free years; GEICO offers earned or purchased options; Travelers bundles forgiveness within its Responsible Driver Plan (e.g., one accident and one minor violation in a 36‑month window); and Nationwide sells accident forgiveness to prevent a rate increase after your first at‑fault accident. Always confirm eligibility rules and state availability before relying on forgiveness to shield your rates.

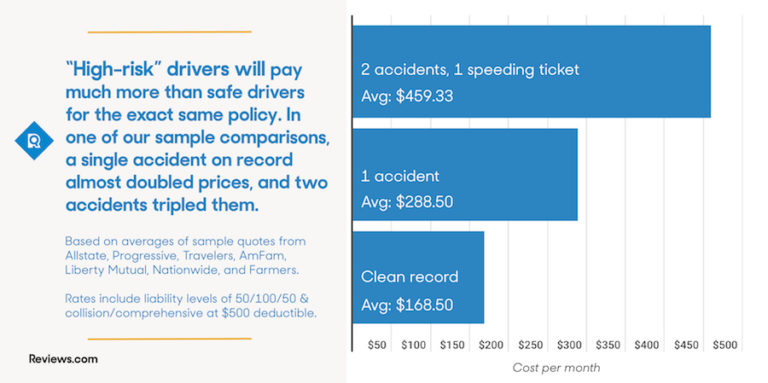

To illustrate the stakes, market studies consistently show that high‑risk drivers pay substantially more for equal coverage than claim‑free drivers. If you currently have an accident or ticket on record, be patient, keep quotes current at renewal, and consider whether a telematics program or eligible accident‑forgiveness option could mitigate future increases (subject to your state’s rules).

If you currently have an accident or ticket on record, be patient. Many companies offer accident-forgiveness programs that reduce rates each year you go without an accident. In addition, be sure to compare rates when your current policy expires. Having gone a year claims-free might mean that you can find a better deal elsewhere next time you shop.

5. Consider usage-based insurance

UBI/telematics programs are now mainstream. Most major carriers use smartphone apps and, increasingly, connected‑car data to measure behaviors tied to risk — like hard braking/acceleration, speeding, time of day, and phone distraction — and translate them into feedback and potential savings. The NAIC notes these programs can reduce premiums for safer or lower‑mileage drivers; some programs may increase rates for risky driving where state rules allow. Examples include Progressive, Allstate, State Farm, Travelers, Nationwide SmartMiles (pay‑per‑mile), and Liberty Mutual. Tech trends include smartphone‑first data capture via platforms like Cambridge Mobile Telematics and growing use of embedded vehicle data through exchanges like LexisNexis Telematics Exchange. Newer entrants underscore this shift (e.g., Tesla Insurance ties monthly premiums to a real‑time Safety Score; Lemonade Car builds telematics‑first features into its app). Always review whether your state permits surcharges and what data is collected before enrolling.

6. Re-evaluate coverage on older cars

Collision and comprehensive coverage helps repair or replace your car in any number of scenarios, from a straight-up car crash to a big hailstorm or a break-in. These options are especially valuable on newer cars with high replacement costs — which is why many lenders require them if you’ve taken out a loan or lease on your vehicle. That said, if you have a low-value “clunker” car, it may not be worth paying higher premiums for collision and comprehensive coverage.

Bill Hebert, Regional Director at Mercury Insurance, puts it this way: “If the shopper has an older vehicle that isn’t worth more than the deductible on a comprehensive policy, they should determine if that is something worth the additional premium.” Deductibles are generally $500 or $1,000. If your car’s overall value falls below that marker, then you may be better off saving yourself the out-of-pocket after an accident and investing in a new (used) vehicle instead.

Pro tip: Not sure how much your car is worth? Use Kelley Blue Book to determine its value; this company is the industry standard in vehicle pricing.

7. Maintain a good credit score

Credit scores play a major role in many states. A 2024 national analysis found drivers with poor credit pay about 96% more, on average, than those with excellent credit for the same coverage (in states where credit is permitted). Some states prohibit using credit in personal auto pricing — prominently California, Hawaii, and Massachusetts — while others impose strict guardrails and disclosures. Colorado’s SB21‑169 further requires insurers to test external data and models (including credit) to demonstrate they don’t lead to unfair discrimination. See the NAIC consumer guide on CBIS, the 2024 State of Auto Insurance findings, and Colorado’s SB21‑169 framework. Where allowed, paying bills on time and keeping balances low can materially lower your premium over time.

8. Review rates annually

Insurers adjust rates regularly, so compare quotes at each renewal — especially after changes in address, drivers, vehicles, mileage, or if state rules/limits shifted (e.g., California and Virginia liability minimum increases effective 2025). Many carriers also offer administrative discounts worth checking: pay‑in‑full, autopay, paperless/eDocs, and online quote/signing (see Allstate and Progressive). Starting early can add savings: early‑quote/early‑signing discounts are currently offered by multiple national insurers, typically when you quote or bind before your current policy expires or before the new policy’s effective date (lead times range from at least 1 day to 7+ days depending on carrier and state): Progressive (quote ≥1 day in advance), Travelers (quote before current policy expires), Liberty Mutual (purchase before current policy ends), American Family (buy ≥7 days before effective date), Erie (quote ≥7 days before start), Allstate (early signing), and Nationwide (advance quote). Note that GEICO’s listed auto discounts do not include an early‑signing discount.

Some car insurance companies even offer an “early quote” or “early signing discount” if you start shopping around before your current policy is up. Savings and eligibility depend on how early you start and your state. Current examples include: Progressive (quote at least 1 day ahead), Travelers (quote before your existing policy expires), Liberty Mutual (purchase before your current policy ends), American Family (7‑day early‑bird), Erie (quote 7+ days in advance), Allstate (early signing), and Nationwide (advance quote). Not every insurer offers this; GEICO’s auto discount list does not include an early‑signing discount.

The Bottom Line

It’s not worth paying for car insurance that won’t protect you (or your wallet) in the event of a serious accident, so your first step in purchasing car insurance should be figuring out how much coverage you really need. Confirm your state’s minimums and special rules (e.g., no‑fault/PIP states, UM/UIM mandates, and 2025 minimum changes in CA and VA), then leverage proven savings levers backed by current insurer pages and regulator guidance: bundling/multi‑vehicle, safe‑driver and driver‑training discounts, vehicle safety/anti‑theft, administrative savings (pay‑in‑full, autopay, paperless, online quote/sign), usage‑based telematics where available, accident forgiveness (if eligible in your state), and early‑quote timing when switching carriers.

- Compare quotes from at least three companies (factor in state rules like credit usage bans and required PIP/UM/UIM where applicable)

- Check options to bundle with home or life insurance (and add multi‑vehicle where possible)

- Drive safely and stay claim-free (consider accident forgiveness if eligible in your state)

- Review rates every time your policy is up — and shop early to qualify for advance‑quote/early‑signing discounts

- Re-evaluate coverage on older cars (collision/comprehensive may not be cost‑effective on low‑value vehicles)

- Maintain a good credit score (where credit is permitted, poor credit averaged ~96% higher premiums vs. excellent in a 2024 study)

- Look for specialty discounts (military, federal employee, good student, defensive driving, EV/hybrid where offered)

- Consider usage-based insurance (behavior‑ or mileage‑based programs can reduce costs depending on driving and state rules)

For more on cheap car insurance, check out some of our other pieces: