Tesla’s worse-than-expected losses per share weren’t the only head-turning news that came out of a Q1 earnings call with Elon Musk last Wednesday. We also learned Musk will be getting his hands on even more of the customer experience by offering in-house car insurance for Tesla customers — supposedly starting sometime next month.

“The answer is yes,” said Musk, “we are creating a Tesla insurance product, and we hope to launch that in about a month. It will be much more compelling than anything else out there.” Since that call, Tesla Insurance launched in California in 2019 and later added a telematics-based product tied to a driver Safety Score in additional states. As of 2025, Tesla offers quoting, policy management, and claims in the Tesla app and web portal, with availability limited to select U.S. states listed on the official support page (Tesla Insurance | Support).

What will make Tesla’s coverage so much “more compelling” for its drivers than other insurance products? Today, the differentiator is behavior-based pricing that, in participating states, updates monthly using the Tesla Safety Score, in-app policy administration, and an emphasis on OEM parts and approved repair networks. Outside California, premiums can adjust based on Safety Score factors and mileage; California’s product follows traditional rating and does not use real‑time telematics (Tesla Insurance | Support; Safety Score). On costs, 2024 benchmark studies show Teslas (especially Model S/X) generally cost more than average to insure, though some drivers report savings with Tesla Insurance depending on state and driving behavior (Bankrate Tesla insurance).

“[Companies like] Geico and State Farm are basically fleecing Tesla owners,” venture capitalist and CNBC contributor Gene Munster told the station on Wednesday. “Those cars are less likely to get in accidents but they charge more in premiums.” Since then, industry data has emphasized that higher claim severity for technology-dense EVs is the primary driver of elevated premiums rather than crash frequency alone, with insurers citing parts costs, ADAS calibration, and labor/repair-cycle time as key contributors (CCC Crash Course 2025; Mitchell EV Collision Insights 2025).

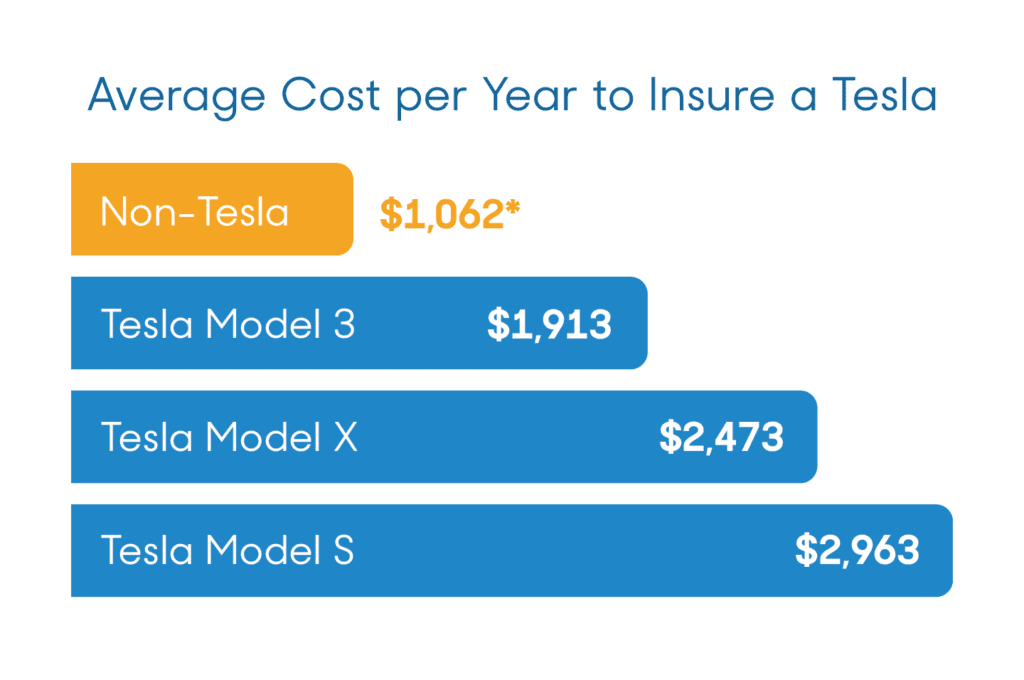

There’s no definitive answer as to why it costs so much more to insure a Tesla, though insurance analysis sites like AutoNews and ValuePenguin blame a large part of the rate hike on collision and comprehensive coverage, which are much pricier for luxury — not to mention, electric — vehicles.

According to 2024, same‑methodology benchmarks from Bankrate (40‑year‑old driver profile), typical full‑coverage premiums average roughly ≈$2,574 for a Model 3, ≈$2,879 for a Model Y, ≈$4,066 for a Model S, and ≈$4,275 for a Model X. Other aggregators like Value Penguin and The Zebra corroborate that Teslas, particularly S/X, tend to sit well above average, with state and driver profile driving large swings.

Compared to the most recent nationwide full‑coverage average from the same source — about ≈$2,543 (Bankrate, 2024; consistent methodology, national average) — the gaps are modest for Model 3 (+~1%) and Model Y (+~13%) but steep for Model S (+~60%) and Model X (+~68%). The National Association of Insurance Commissioners publishes historical premium data and methods; use the Bankrate 2024 figures here for apples‑to‑apples comparisons, and recheck those pages for refreshed 2025 tables.

*Historical sources include the National Association of Insurance Commissioners. Current comparison figures in this article use 2024 model‑specific and national averages from Bankrate (Tesla models) and Bankrate (U.S. average) for methodological consistency; actual premiums vary by state, coverages, and driver profile.

The need for a better insurance solution for Tesla drivers might seem clear. But the question remains of how Musk plans to lower insurance rates for his customers. It’s a very particular challenge.

High replacement costs aside, insuring Teslas has been an ongoing challenge for providers as they struggle to reconcile the accuracy of their underwriting predictions with the cars’ newfangled semi-autonomous capabilities.

“Individually owned vehicles with semi-autonomous features (and full autonomy in the future) are difficult for insurers to assess,” writes Peter Newman, a Research Analyst at Business Insider, “because various parties will contest how well the systems perform.” In practice today, most U.S. carriers use general telematics signals (speeding, braking, time of day, phone distraction) or give credits for ADAS presence rather than automation usage; the primary at‑scale exception is Tesla Insurance’s Safety Score, which explicitly includes Forced Autopilot Disengagements among its factors (LexisNexis 2024 Telematics Trends; Safety Score).

And as for Musk? Unsurprisingly, he’s confident in the reliability of Tesla’s self-driving features when it comes to road safety and accident prevention. In fact, the company’s insurance rates will likely depend heavily on tracking data from the vehicles’ Autopilot systems. These allow the company to gather real-time data about usage and driving habits, which it would then use to build out profiles for customers and set insurance prices accordingly.

The potential incorporation of Autopilot data has given some reporters and Tesla enthusiasts pause. Tech website ExtremeTech, for one, calls it “spying,” and claims that “knowing the big brother is watching [will] dampen the enthusiasm of many drivers.”

We’ll admit, it sounds a little creepy. But the fact of the matter is, if you drive a Tesla, your insurance company likely already has access to your driving data to some extent. Musk said as much in the earnings call on Wednesday.

“We do give some more detailed information to insurance companies to help with rates. And obviously as we launch our own insurance product next month, we will certainly incorporate that information into the insurance rates.”

Elon Musk, CEO of Tesla

Tesla isn’t the only company tracking customers’ commutes in an effort to lower insurance rates. Insurers like Progressive and Allstate have offered monitored driving discounts since as early as 1998.

These programs promise big savings for customers willing to install a telematic tracker in their vehicle to prove that they consistently observe safe driving habits. The devices collect data on drivers’ speed, braking, lane departure, and more — essentially, all the things Tesla’s insurance would take into consideration.

The difference? Telematic trackers from companies like Progressive are 100% optional. You must elect to join the program and have a physical tracking device installed in your car, leaving no question that you are aware and have agreed to be monitored in exchange for a cheaper insurance rate.

With Tesla’s proposed insurance, Musk has made it clear your vehicle and driving data will continue to play a key role in how your car is insured — potentially to an even greater extent than with third-party insurers.

How repellent that implied consent is to Tesla’s potential insurance customers will likely be determined post-launch, when we have a better feel for how much money a tracking-based insurance program could actually save Tesla drivers. Until then, Tesla owners may want to start weaning themselves off the ultra-fast Ludicrous mode.