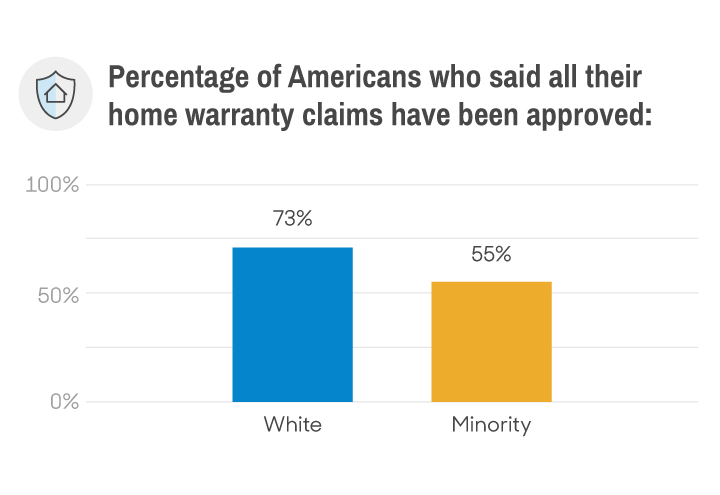

Recent, authoritative public sources do not report home warranty claim approval or denial rates by race or ethnicity. State regulators publish company-level claim counts and complaint ratios, but none include demographic outcomes. For context and verification, see California’s Home Protection Company filings and complaint studies (California Department of Insurance; California DOI complaint ratios), Texas’s Residential Service Company oversight (Texas Real Estate Commission; Texas Department of Licensing & Regulation), the FTC’s national complaint reporting (FTC Consumer Sentinel), and current homeownership distributions to contextualize exposure (U.S. Census CPS/HVS).

What the latest data can show today: regulators in California and Texas publish annual, company-level counts of claims received, paid, denied, and pending for home warranty/service contract firms. The most recent California filings cover 2023 activity (published 2024), and Texas posts analogous Residential Service Company reporting; neither collects race/ethnicity on claimants (California DOI; TREC). To measure any current approval-rate disparities by race or ethnicity, new primary data are required—either a representative survey weighted to the Census Bureau’s CPS/HVS Table 5 or regulator-facilitated extracts with demographic fields linked via privacy-preserving methods.

Methodological path to updated evidence: a rigorous update would sample warranty holders who filed claims in the past 12–24 months; capture outcomes (approved/partial/denied), dollar amounts, reasons for denials, appeals, provider, and demographics; and then weight the results to national homeownership distributions by race/ethnicity from the CPS/HVS. A complementary approach is a regulator-led data request for standardized, de‑identified claim files from major firms. Both paths would produce approval-rate estimates with confidence intervals and allow controls for confounders (home age, income, state, and company).

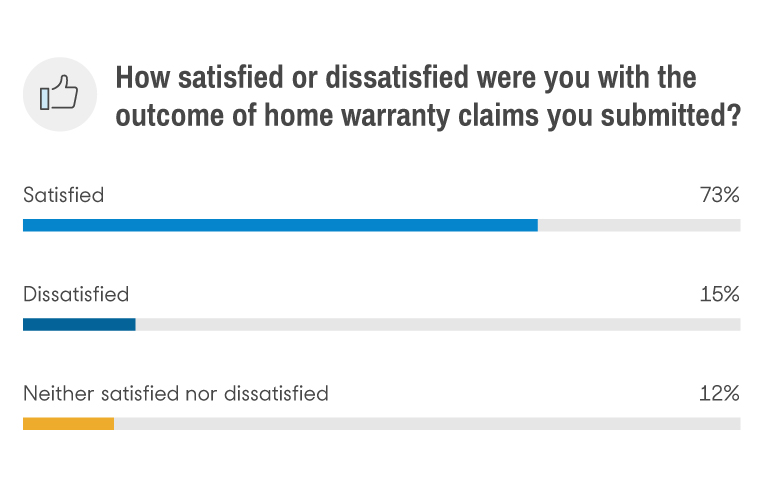

Consumer experience and satisfaction signals remain mixed. National complaint reporting for “Warranties and Service Contracts” continues to be substantial in the FTC’s latest annual data release, underscoring persistent friction points (FTC Consumer Sentinel 2024). California publishes standardized Home Protection Company complaint ratios (justified complaints per 100,000 contracts) that show wide variability across providers—an objective proxy for differences in claim handling quality (California DOI). Texas reports ongoing complaints and enforcement themes centered on denials tied to exclusions, delays, and contractor performance (TDLR). Independent benchmarking also highlights communication, timeliness, and coverage clarity as key satisfaction drivers (J.D. Power 2024 U.S. Home Warranty Satisfaction Study), while the BBB documents recurring consumer disputes over “fine‑print” exclusions and unexpected costs (BBB guidance).

Public datasets do not tie claim approval rates to age, education, or income in the home warranty market. However, current regulator and consumer guidance identifies denial catalysts—pre‑existing conditions, improper installation, lack of maintenance records, sub‑limits, and excluded parts/labor—that make documentation and contract literacy pivotal for success (FTC: Home warranties). Broader research shows lower financial literacy and lower broadband adoption among lower‑income or lower‑education households, which plausibly impedes timely, well‑documented filings and appeals (FINRA National Financial Capability Study; Pew: Who has home broadband?). These mechanisms can affect outcomes even though no SES-linked approval statistics are published by home warranty regulators today.

Daniel Schwarcz, a law professor at the University of Minnesota, has studied proxy discrimination, which occurs when systems that are meant to be neutral (like the AI algorithms many insurance companies are now using) develop unintentional biases toward certain groups. According to a study by Schwarcz and Anya Prince in the Iowa Law Review, “proxy discrimination need not be intentional.” Regulators have begun setting guardrails: Colorado adopted first‑in‑nation rules to prevent unfair discrimination from algorithms and predictive models (Colorado Division of Insurance), and the NAIC issued a Model Bulletin on AI use by insurers, emphasizing governance, testing, and vendor oversight (NAIC).

In practice, automated triage, eligibility rules, fraud scoring, and dispatch optimization can speed simple, clearly covered claims—but they can also scale erroneous or biased denials if models lean on proxy variables (e.g., ZIP‑level socioeconomic data, property age, or network availability). Federal agencies jointly warn that automated systems that yield discriminatory outcomes can violate existing laws even when protected traits are not used directly (Joint federal statement on AI bias enforcement). Strong governance, explainability, and periodic disparate‑impact testing are therefore essential to fair claims handling.

The survey did not name or collect information about specific home warranty companies. Instead, it focused on home warranty customer’s experiences with their own home warranty plans and claims.

Asked about the survey’s findings on racial disparity, America’s Preferred Home Warranty spokesperson Mike Sadler expressed surprise. Sadler said their claims determinations make no judgment based on race or other personal attributes.

“There’s just no way in our process for something like that to occur,” Sadler said. “We’re a Christian-based company and we work really hard and we care about our customers. Race, color, none of those things matter anything to us.”

Ray Carlisle is the founder and president of the National Association of Real Estate Brokers Investment Division, a housing counseling agency serving urban and minority families in 22 states. Disparate treatment by home warranty providers may be unintentional, but Carlisle was adamant about the company’s overarching motivation to maximize profits.

Independent indicators converge on the same satisfaction levers: clear coverage terms, timely dispatch/repairs, and transparent costs drive better experiences; denials based on exclusions, poor communication, and delays drive complaints. These themes appear across California’s company-level complaint ratios (California DOI), Texas enforcement/complaint summaries (TDLR), and independent satisfaction research (J.D. Power 2024).

Experts caution that if companies focus on minimizing complaints and costs, decision rules—manual or automated—can still produce disparate impacts without intent, especially when relying on proxy signals like geography or external consumer data. Robust AI governance policies, data minimization, transparent denial reasons, human‑in‑the‑loop review for borderline cases, and accessible appeals reduce this risk (NAIC AI Model Bulletin; Colorado DOI).

Even if a company doesn’t ask a home warranty customer for their demographic information, Carlisle said they “geocode everything.” An algorithm isn’t designed to map minority areas, but if it breaks down location by other factors, such as income or crime, it could unintentionally cut across those lines.

”Everybody measures their risk in different ways, and yes there is racial discrimination in the measuring of those risks. Companies will say they’re not discriminating, they’ll say they’re measuring risk factors based on historical data,” Carlisle said.

It is important to view any legacy, self‑reported survey charts as perception data, not verified approval rates. Current regulator sources provide better, objective benchmarks for company performance: California publishes annual Home Protection Company activity and complaint ratios, and Texas maintains Residential Service Company oversight and complaint processes; neither dataset includes race/ethnicity fields (California DOI filings; California DOI complaint ratios; TREC; TDLR).

“We encourage consumers to be educated, and we try to educate them.” Asked about the survey results, Chartrand speculated that the discrepancies may not have anything to do with the provider, but instead could be due to the consumer’s “expectation levels … whether they read contracts, things like that.”

In addition to lack of understanding, home warranty customers often have little say in their provider. A home warranty will often be provided by the seller or real estate agent as an added “bonus” for the home buyer. According to Chartrand, many buyers see this as a good thing because real estate agents are familiar with the best providers. Even so, it’s a good idea for consumers to shop around and generate their own opinions about providers.

Carlisle encourages home buyers to read their home warranty policies because they may be able to ask a seller to upgrade it, even if it means paying for the difference out of pocket.

It’s important to note companies aren’t totally to blame, and consumer knowledge gaps are likely playing a part in these discrepancies, Carlisle said. “Disparate treatment is inherent in our society. That’s why it’s very important that everybody understands what they’re buying … you have to be able to advocate for yourself.”

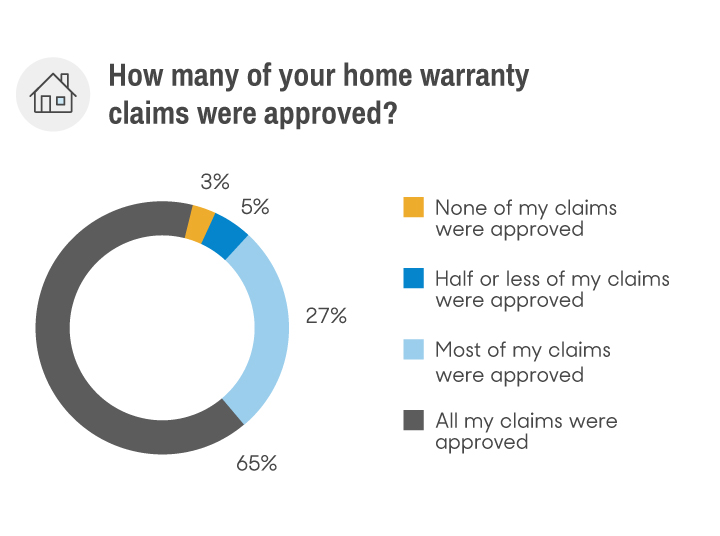

Home warranties are infamously confusing, but that doesn’t mean policies are going unused. State reports show substantial claim volumes each year, reinforcing the importance of understanding filing requirements and documentation before problems arise (California DOI filings; TREC).

If you have a home warranty, read your contract. Then, if you have any more questions, check out these resources:

- What Is a Home Warranty?

- 8 best home warranty companies

- Do I need homeowners insurance and a home warranty?

- Do I need a home warranty?

- Home Service Club

- AFC Home Club

- Choice Home Warranty

- TotalProtect Home Warranty Review

- American Home Shield

Reviews.com commissioned YouGov Plc to conduct the survey. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 2,584 adults. Fieldwork was undertaken Aug. 1-4. The survey was carried out online and meets rigorous quality standards. It employed a non probability-based sample using both quotas upfront during collection and then a weighting scheme on the back end designed and proven to provide nationally representative results. To assess present-day disparities, additional primary research is needed—either a new representative survey weighted to CPS/HVS Table 5 homeownership distributions or regulator-facilitated, standardized claim extracts. For ongoing market context, consult current regulator datasets and consumer protection materials on claims and complaints (California DOI filings; TREC; TDLR; FTC Consumer Sentinel), and note the FTC’s enforcement against deceptive denials in this sector (FTC v. Choice Home Warranty).