Many homeowners are all too familiar with Murphy’s Law: what can go wrong will go wrong. A home warranty is a service contract (not homeowners insurance) that helps pay for repair or replacement of specified systems and appliances due to normal wear and tear. Typical plans cost about $450–$700 per year with per‑visit service fees commonly around $75–$125, and many contracts include waiting periods and per‑item caps (often in the $2,000–$3,000 range for appliances). Always review the full contract and exclusions before you buy (FTC; Forbes Advisor).

If you’ve been wondering if you need a home warranty, here’s the latest read on customer experience: a 2024 national survey reported that 49% of consumers who filed a home warranty claim were satisfied with the outcome of their most recent claim, while many encountered denials or only partial coverage (Forbes Advisor, 2024). Recent guidance from Consumer Reports similarly cautions that exclusions and pre‑existing‑condition rules frequently limit payouts and value.

According to that same 2024 survey snapshot, roughly half were satisfied with their most recent claim outcome, but a significant share reported denials or only partial coverage and frustrations with timeliness (Forbes Advisor). Recent enforcement and complaint activity helps explain the mixed results: the FTC’s 2023 action against Choice Home Warranty alleged deceptive claim denials (e.g., citing pre‑existing conditions or improper maintenance), and the BBB highlights recurring complaints about denied claims, fine‑print exclusions, delays, and cancellation/refund disputes.

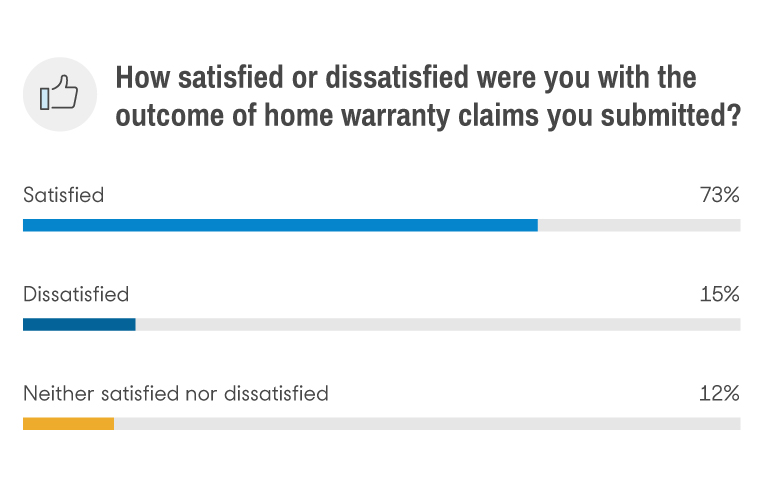

For many Americans, a home will be the biggest purchase they ever make. Use a home warranty, if you choose one, as a budgeting tool—not a guarantee—because coverage depends on caps, exclusions, and service fees. Note: The chart above reflects historic survey data; see the updated 2024–2025 statistics and linked sources in this article for current satisfaction context (Forbes Advisor; Consumer Reports).

However, shoppers still tend to compare only a small shortlist of providers even though plan terms vary widely. Today’s buyers research and purchase online, relying on search and third‑party reviews, and they increasingly trade a higher service (trade‑call) fee to lower monthly premiums—most standard plans fall around $450–$700 annually with $75–$125 service fees (Forbes Advisor). Before enrolling, compare sample contracts side by side and check complaint history with regulators and the BBB to avoid surprises.

Art Chartrand, executive director of the National Home Service Contract Association, thinks consumers are missing out if they’re not shopping around—and verifying licensure and complaint records with their state regulator (for example, California Department of Insurance or Texas regulator resources).

“Consumers need to shop around – for everything. We (as in The National Home Service Contract Association) are a big believer in people being educated” Chartrand says “The better educated they are, the better we are … we have a pretty competitive industry out there, and it’s a good thing. You should get competitive quotes.”

At the beginning of the home warranty industry, contracts were purchased through real estate agents in connection with the sale of a home, says Chartrand. That channel is still important, but more buyers now comparison‑shop and purchase plans directly online. Our guide to the best home warranty companies can help get you started; also review state regulator listings and complaint data alongside sample contracts to validate coverage and limits (California DOI; Texas regulator).

But “don’t shop around just on price,” Chartrand says. “Price is one factor but … you want to make sure that these people are providing the experience and satisfaction … at the time you have a claim.” Compare coverage caps and exclusions (many plans set per‑item limits such as ~$2,000–$3,000 for appliances), service fees ($75–$150 typical), workmanship guarantees, contractor policies, and complaint records. Some providers differentiate on repair guarantees—Cinch, for example, advertises a 180‑day workmanship guarantee on covered repairs (U.S. News 360 Reviews; Cinch guarantee).

In some cases, it may be hard to shop around because the home you’re purchasing comes with a home warranty policy.

In this case, it’s still a good idea to read the policy. Ray Carlisle, founder

Overall, current independent data indicate claim satisfaction is mixed. In a 2024 national survey, 49% of claimants reported satisfaction with their most recent outcome, while many experienced denials or only partial coverage; complaint themes tracked by the BBB—denials tied to exclusions, delays, and cancellation/refund disputes—align with these results (Forbes Advisor; Consumer Reports).

“Before buying a home warranty, your biggest question is probably whether it’ll actually cover the things it’s supposed to,” says Adam Morgan, Senior Finance Editor for Reviews.com. “Recent consumer data show that overall claim satisfaction is modest and closely tied to exclusions, dollar caps, and response times—so compare plans carefully, verify caps and waiting periods, and read the fine print from the provider and state regulator resources before deciding if a home warranty is worth the cost for your home” (FTC; California DOI).

For real estate agents and sellers, including a home warranty with the sale of the property can provide targeted value for buyers concerned about older systems. Agencies note that seller‑paid warranties are a common, relatively low‑cost concession, but it’s important to set expectations about exclusions, caps, service fees, claims processes, and cancellation/refund terms (Freddie Mac; FTC).

Study Methodology

Reviews.com commissioned YouGov Plc to conduct the survey. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 2,584 adults. Fieldwork was undertaken Aug. 1-4. The survey was carried out online and meets rigorous quality standards. It employed a non probability-based sample using both quotas upfront during collection and then a weighting scheme on the back end designed and proven to provide nationally representative results. Because the survey used a nonprobability online panel with weighting, classical margins of error do not strictly apply; transparency and appropriate uncertainty framing are recommended by AAPOR and Pew Research Center. To reflect the most current marketplace experience, we also cite recent 2024–2025 sources on claim satisfaction, complaints, costs, and shopping behavior, including Forbes Advisor, Consumer Reports, the FTC, and the BBB.

What’s Next

Guides and Resources

- best home warranty companies

- Do I need homeowners insurance and a home warranty?

- if you need a home warranty