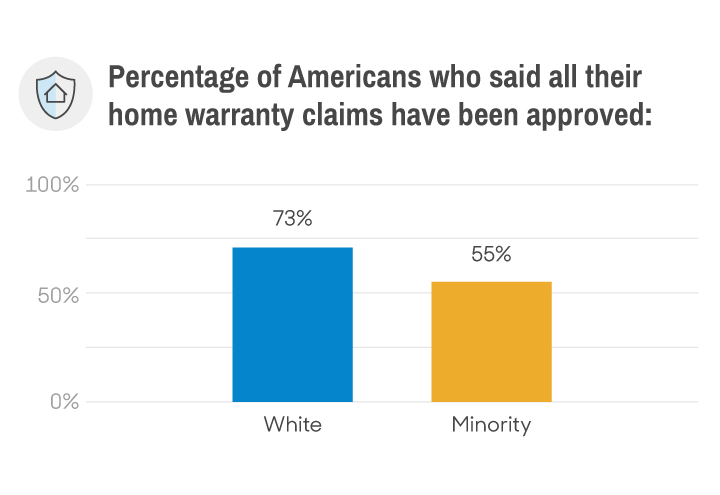

White Americans are more likely to say their home warranty claims were approved than minorities, a Reviews.com survey shows.

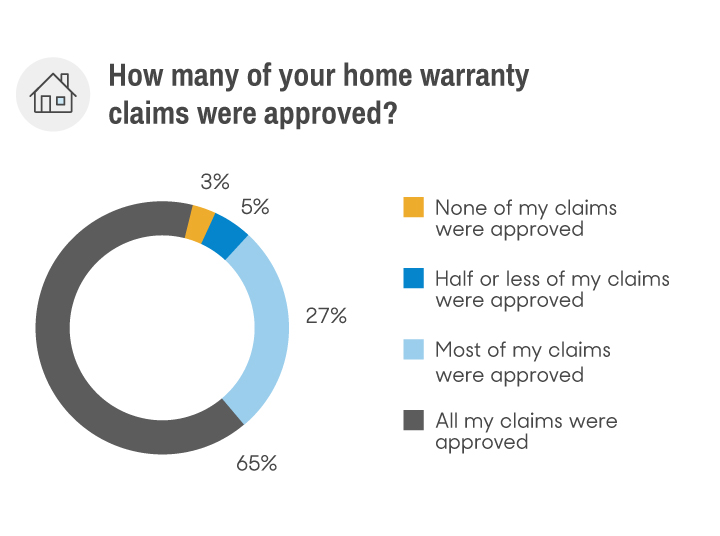

The survey, which Reviews.com commissioned and was carried out by YouGov, surveyed 2,584 people who had bought warranties for their homes. Of the respondents, 73% of white Americans reported that all of their claims were approved, while only 55% of minorities — which include black, hispanic, Asian, Native American, middle-eastern, mixed, and other — reported the same. Overall, 65% of Americans said all of their claims were approved.

The study only provides data on self-reported claims approval, and should be seen in that regard. While it does not provide verifiable information on how many claims were approved or rejected by providers, it does provide context on how people who have had and used home warranties perceive their experiences with them.

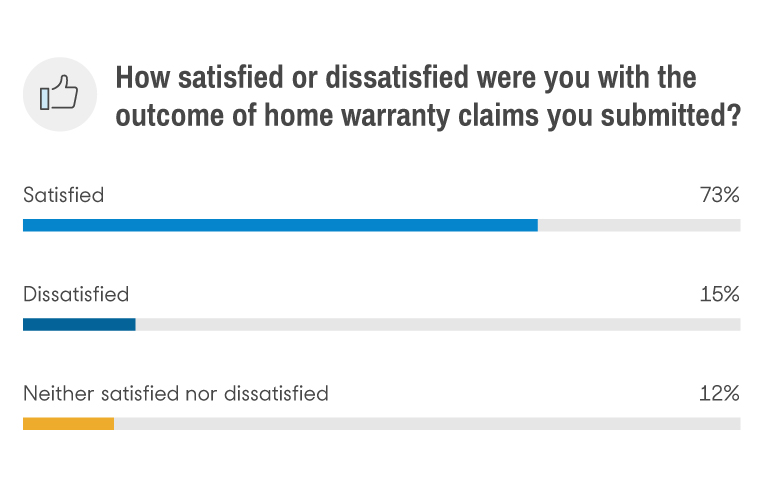

Among U.S. adults who have purchased a home warranty and have filed a claim, 73% were satisfied with the outcome. The survey also found that despite having a significant difference of all claims being approved, minorities had similar satisfaction with their claim outcomes compared to whites.

Beyond the racial disparity in self-reported claims approvals, young people reported having had more claims denied than older Americans. Only 47% of 18- to 34-year-olds said all their claims had been approved, versus 71% of 35- to 54-year-olds and 77% of those 55 and older. Those with at least a four-year degree were 15% more likely to say all of their claims were approved than those with less education. And, those who earn $80,000 or more were 18% more likely to say all of their claims were approved than those earning less.

Daniel Schwarcz, a law professor at the University of Minnesota, has studied proxy discrimination, which occurs when systems that are meant to be neutral (like the AI algorithms many insurance companies are now using) develop unintentional biases toward certain groups. According to a study by Schwarcz and Anya Prince in the Iowa Law Review, “proxy discrimination need not be intentional.”

In an interview about the home warranty study, Schwarcz described how the disparities in self-reported home warranty claims could conceivably be a sign of proxy discrimination. Even if a company approves claims based solely on business reasons, there may be differences between groups that encourage lower approval rates for some of those groups. “It’s possible, for instance, that maybe Hispanic and African-American communities are less likely to fight if they’re denied a claim and … there’s some profit-maximizing motive that makes it sensible to have a different claims approval rating for different groups,” Schwarcz said.

The survey did not name or collect information about specific home warranty companies. Instead, it focused on home warranty customer’s experiences with their own home warranty plans and claims.

Asked about the survey’s findings on racial disparity, America’s Preferred Home Warranty spokesperson Mike Sadler expressed surprise. Sadler said their claims determinations make no judgment based on race or other personal attributes.

“There’s just no way in our process for something like that to occur,” Sadler said. “We’re a Christian-based company and we work really hard and we care about our customers. Race, color, none of those things matter anything to us.”

Ray Carlisle is the founder and president of the National Association of Real Estate Brokers Investment Division, a housing counseling agency serving urban and minority families in 22 states. Disparate treatment by home warranty providers may be unintentional, but Carlisle was adamant about the company’s overarching motivation to maximize profits.

The survey also found that despite having a significant difference of all claims being approved, minorities had similar satisfaction with their claim outcomes compared to whites. To Schwarcz, this finding is in line with a home warranty’s goal of maximizing customer satisfaction.

“If an insurer’s goal is to limit complaints and have satisfaction, [and they] can continue to have an acceptable level of consumer satisfaction even by denying more claims … it’s very likely that [they] might start adopting some sort of approach that differentially pays claims that link to race or ethnicity because that’s essentially going to help [them] achieve a profit maximizing goal,” he said.

Even if a company doesn’t ask a home warranty customer for their demographic information, Carlisle said they “geocode everything.” An algorithm isn’t designed to map minority areas, but if it breaks down location by other factors, such as income or crime, it could unintentionally cut across those lines.

”Everybody measures their risk in different ways, and yes there is racial discrimination in the measuring of those risks. Companies will say they’re not discriminating, they’ll say they’re measuring risk factors based on historical data,” Carlisle said.

It is important to note the survey results only indicate a claimant’s perceived and self-reported experience. Satisfaction and even claims approval can be subject to interpretation, especially with a subject as nuanced and complex as home warranties. According to Art Chartrand, executive director of the National Home Service Contract Association, providers should have reasonable consumer expectations in mind when drawing up contracts, especially since customers usually won’t read a contract until they’re ready to make a claim.

“We encourage consumers to be educated, and we try to educate them.” Asked about the survey results, Chartrand speculated that the discrepancies may not have anything to do with the provider, but instead could be due to the consumer’s “expectation levels … whether they read contracts, things like that.”

In addition to lack of understanding, home warranty customers often have little say in their provider. A home warranty will often be provided by the seller or real estate agent as an added “bonus” for the home buyer. According to Chartrand, many buyers see this as a good thing because real estate agents are familiar with the best providers. Even so, it’s a good idea for consumers to shop around and generate their own opinions about providers.

Carlisle encourages home buyers to read their home warranty policies because they may be able to ask a seller to upgrade it, even if it means paying for the difference out of pocket.

It’s important to note companies aren’t totally to blame, and consumer knowledge gaps are likely playing a part in these discrepancies, Carlisle said. “Disparate treatment is inherent in our society. That’s why it’s very important that everybody understands what they’re buying … you have to be able to advocate for yourself.”

Home warranties are infamously confusing, but that doesn’t mean policies are going unused. Only 28% of home warranty purchasers had never filed a claim, meaning that most policies are actually being used.

If you have a home warranty, read your contract. Then, if you have any more questions, check out these resources:

- What Is a Home Warranty?

- 8 best home warranty companies

- Do I need homeowners insurance and a home warranty?

- Do I need a home warranty?

- Home Service Club

- AFC Home Club

- Choice Home Warranty

- TotalProtect Home Warranty Review

- American Home Shield

Reviews.com commissioned YouGov Plc to conduct the survey. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 2,584 adults. Fieldwork was undertaken Aug. 1-4. The survey was carried out online and meets rigorous quality standards. It employed a non probability-based sample using both quotas upfront during collection and then a weighting scheme on the back end designed and proven to provide nationally representative results.