Since the dawn of streaming services, minimalists, TV fanatics, and budgeters have been asking if they should sever their cable contracts (also known as “cutting the cord”). That trend has only intensified: Leichtman Research Group’s recent accounting shows major U.S. pay‑TV providers shed about 5,035,000 subscribers in 2023 and still account for roughly 71.3 million subscriptions across the companies it tracks cable and satellite TV industry lost 1.7 million video subscribers. In parallel, Nielsen’s The Gauge consistently shows streaming as the largest share of total TV usage in 2025, ahead of both cable and broadcast.

But is canceling cable contracts and signing up for streaming actually worth it? It depends. Your savings and experience hinge on what you watch and how you assemble services. Live TV streaming bundles (vMVPDs) now run about $73–$95+ per month depending on plan and regional sports fees (for example, YouTube TV is $72.99/month; Hulu + Live TV starts at $76.99; and Fubo’s Regional Sports Fee adds ~$11–$14/month in many markets). On‑demand services are cheaper—especially ad‑supported tiers—but prices rose in 2024–2025 and many platforms now steer sign‑ups to ad plans and bundles Antenna Comscore.

To gauge more individual experiences, we surveyed a small portion of the internet about their cord-cutting thoughts. In our survey, we found that a slight majority (60% of 1,307 total respondents) haven’t cut the cord entirely. We learned that 34% of survey respondents still pay for cable or satellite TV service only, while 26% pay for both cable or satellite TV service and streaming services. Today, broader industry tracking shows streaming is nearly ubiquitous—88% of U.S. TV households have at least one SVOD—even among homes that keep traditional TV.

Our survey focused on the 21% of respondents that have completely cut the cord — leaving cable and satellite behind in favor of streaming. Since then, cord-cutters increasingly rely on ad‑supported tiers, rotate subscriptions around new seasons, and use free ad‑supported streaming TV (FAST) apps to fill gaps—trends validated by subscription trackers and CTV measurement in 2025 Antenna Comscore.

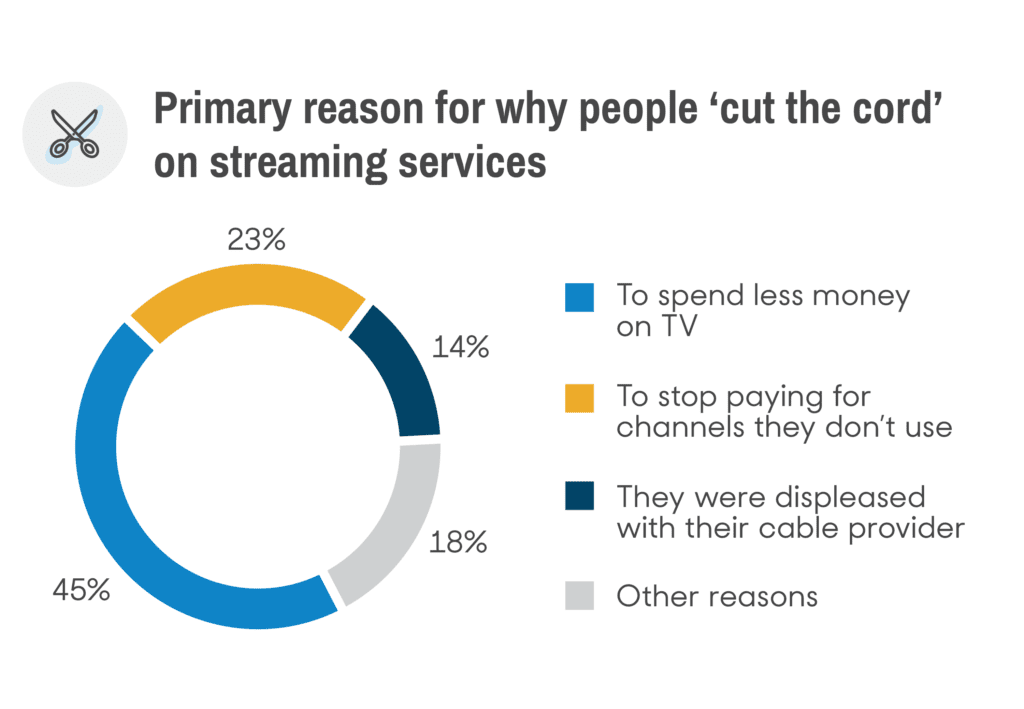

Here’s what we learned about why people switch to streaming:

Finances remain the dominant driver. Traditional bundles layer provider surcharges and equipment rental, while vMVPDs have raised prices into cable‑adjacent territory. Typical live TV streaming totals are now $73–$95+ monthly before optional add‑ons (YouTube TV $72.99/month; Hulu + Live TV from $76.99; Fubo RSN fee ~$11–$14 in many markets). Many households lower costs with ad‑supported plans, operator/streamer bundles, and FAST viewing—FAST time spent continues to post double‑digit growth in 2025 Comscore.

And the overwhelming majority of respondents achieved those goals. Of the people who cut the cord, 81% said they are spending less money now. And 86% said it’s unlikely they’ll return to a traditional cable TV contract. Independent satisfaction benchmarking also shows streaming services score materially higher than traditional subscription TV on ease‑of‑use and perceived value American Customer Satisfaction Index (ACSI).

One key to keeping those costs down is limiting the number of streaming services you subscribe to. In 2025, the most budget‑friendly approach is to rotate services and favor ad‑supported tiers. For example, a three‑service ad‑supported stack can run about $23–$26/month—e.g., Netflix (with ads) $6.99 + Hulu (with ads) $7.99 + Paramount+ Essential $7.99—while ad‑free versions of three major services often total around $40–$50/month Netflix pricing Hulu pricing Paramount+ plans.

The takeaway: streaming now leads total TV usage nationally while legacy pay‑TV keeps shrinking, but your savings depend on avoiding full live‑TV bundles when you can. Ad‑supported tiers and FAST services help maintain low monthly spend, and bundles can add value—yet sports fans may need additional subscriptions for complete coverage Nielsen’s The Gauge Leichtman Research Group Comscore.

We’ll walk you through the considerations that should factor into your cord-cutting decision.

What’s next?

- Ready to take leap? Read through our guide to cord-cutting.

- Check out our review of streaming services to help you decide whether on-demand or live streaming is best for you.

- We also tested the different devices. you may need.

- Just need the basics? Consider a TV antenna for free access to local channels.

So, is it worth it?

Price alone doesn’t necessarily dictate whether cord-cutting is worth it. Your bottom line might be similar, but the freedom and flexibility that switching to streaming offers is enticing. Streaming leads U.S. TV usage in 2025 and pay‑TV continues to contract, yet the best value depends on your mix. If you can rely on a few on‑demand services (often $25–$50/month with ads), streaming typically undercuts cable. If you need a full cable‑like live bundle ($73–$95+ before add‑ons) for sports and news, savings may narrow. Sports aggregation is improving—Venu Sports aims to combine ESPN/FOX/WBD networks in one app—and large vMVPDs like YouTube TV (now over 8 million subscribers) show how many fans combine linear‑style access with SVODs Nielsen’s The Gauge Venu Sports YouTube TV subscriber milestone.

Streaming services also allow for more flexibility in how you watch. You can view content on TVs, laptops, tablets, phones, game consoles, streaming devices, etc. You can download content to watch offline and can log in when away from home at hotels and Airbnbs. Month‑to‑month terms, ad‑supported entry tiers, and occasional annual discounts give you more control—though churn is naturally higher than legacy TV, which is why bundles and annual plans are increasingly common Antenna Deloitte.

Cord-cutting expert Sam Cook also told us that you should remain vigilant about your streaming set up by “limiting how many you’re signed up for, and taking full advantage of no long-term contracts by binge-watching series on-demand on various services, and then canceling or suspending your account until you need it again.” With free trials and no cancellation fees, it’s becoming increasingly popular to sign up for services for short-term stints. In practice, this is the “rotate and save” strategy many households use to keep costs predictable while still catching tentpole releases Antenna.

There are more nuanced perks to cutting the cord, too. The interface on streaming devices keeps improving: Fire TV added generative‑AI search for natural‑language discovery, Roku sharpened its Sports and Live TV hubs, and Apple’s tvOS 18 brings features like InSight and better subtitles—no clunky cable boxes required Fire TV AI Roku OS 12.5 tvOS 18.

Our recommendation: Before joining the cord-cutters, consider what you want to watch, calculate your current internet provider packages, and research potential streaming services. Make sure the end result aligns with your goals, whether that’s saving money, freeing yourself from cable contracts, or something else. Some people will find better value bundling traditional services, but many will find more freedom and lower bills after cutting the cord. Use ad‑supported tiers, rotate services, and lean on FAST to minimize spend—and map your sports needs carefully to avoid overbuying.

Study Methodology

Reviews.com commissioned YouGov Plc to conduct the survey. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1,307 adults. Fieldwork was undertaken Sep. 11-12. The survey was carried out online and meets rigorous quality standards. It employed a non probability-based sample using both quotas upfront during collection and then a weighting scheme on the back end designed and proven to provide nationally representative results.

What’s next?

- Ready to take leap? Read through our guide to cord-cutting.

- Check out our review of streaming services to help you decide whether on-demand or live streaming is best for you.

- We also tested the different devices. you may need.

- Just need the basics? Consider a TV antenna for free access to local channels.

There’s still one contract you need

Not every cord can be cut — to use streaming service alternatives, you’ll still need an internet connection. And internet packages still come with contracts, price hikes, and fees. Sometimes, adding a cable channel package for $10-$30 more won’t seem so unreasonable. When reviewing internet providers, we found some providers offer bundles that actually make it cheaper to add TV channels than to purchase an internet-only package. For streaming performance, plan bandwidth based on your household: most homes stream comfortably on 100–300 Mbps down with 10–20 Mbps up; larger families and heavy creators benefit from 300–1000 Mbps down and 20–35+ Mbps up. Per‑stream guidance remains steady—about 5 Mbps for 1080p and ~15 Mbps for 4K on Netflix; YouTube TV recommends ~7+ Mbps for one HD stream and ~13+ Mbps for 4K Netflix speed recommendations YouTube TV bandwidth guidance. Favor fiber where available for low latency and strong uploads; fixed wireless (5G home) can be cost‑effective in many areas; satellite is typically a last resort due to higher latency Google Fiber plans T‑Mobile 5G Home Internet Starlink Residential.

Another thing to keep in mind: If you switch entirely to streaming your TV content, you’ll need a more reliable internet connection. If you don’t have a strong connection (and sometimes even when you do), you might experience buffering when streaming — and no one wants their stream to stop in the middle of a dramatic confrontation or climactic action scene. Higher resolutions and multiple users will require more bandwidth, which comes at a higher cost. A single 4K stream can consume up to ~7 GB/hour; multiple concurrent 4K streams add up quickly. Check for data caps and “Broadband Facts” labels before you buy, and optimize your home network with modern Wi‑Fi 6/6E (or Ethernet for stationary TVs). Mesh systems help large or multi‑story homes. Wi‑Fi 7 is rolling out with higher throughput and lower latency features that further reduce congestion in busy environments Netflix data usage Wi‑Fi 7 overview.

So, is it worth it?

Price alone doesn’t necessarily dictate whether cord-cutting is worth it. Your bottom line might be similar, but the freedom and flexibility that switching to streaming offers is enticing. Streaming leads U.S. TV usage in 2025 and pay‑TV continues to contract, yet the best value depends on your mix. If you can rely on a few on‑demand services (often $25–$50/month with ads), streaming typically undercuts cable. If you need a full cable‑like live bundle ($73–$95+ before add‑ons) for sports and news, savings may narrow. Sports aggregation is improving—Venu Sports aims to combine ESPN/FOX/WBD networks in one app—and large vMVPDs like YouTube TV (now over 8 million subscribers) show how many fans combine linear‑style access with SVODs Nielsen’s The Gauge Venu Sports YouTube TV subscriber milestone.

Streaming services also allow for more flexibility in how you watch. You can view content on TVs, laptops, tablets, phones, game consoles, streaming devices, etc. You can download content to watch offline and can log in when away from home at hotels and Airbnbs. Month‑to‑month terms, ad‑supported entry tiers, and occasional annual discounts give you more control—though churn is naturally higher than legacy TV, which is why bundles and annual plans are increasingly common Antenna Deloitte.

Cord-cutting expert Sam Cook also told us that you should remain vigilant about your streaming set up by “limiting how many you’re signed up for, and taking full advantage of no long-term contracts by binge-watching series on-demand on various services, and then canceling or suspending your account until you need it again.” With free trials and no cancellation fees, it’s becoming increasingly popular to sign up for services for short-term stints. In practice, this is the “rotate and save” strategy many households use to keep costs predictable while still catching tentpole releases Antenna.

There are more nuanced perks to cutting the cord, too. The interface on streaming devices keeps improving: Fire TV added generative‑AI search for natural‑language discovery, Roku sharpened its Sports and Live TV hubs, and Apple’s tvOS 18 brings features like InSight and better subtitles—no clunky cable boxes required Fire TV AI Roku OS 12.5 tvOS 18.

Our recommendation: Before joining the cord-cutters, consider what you want to watch, calculate your current internet provider packages, and research potential streaming services. Make sure the end result aligns with your goals, whether that’s saving money, freeing yourself from cable contracts, or something else. Some people will find better value bundling traditional services, but many will find more freedom and lower bills after cutting the cord. Use ad‑supported tiers, rotate services, and lean on FAST to minimize spend—and map your sports needs carefully to avoid overbuying.

Study Methodology

Reviews.com commissioned YouGov Plc to conduct the survey. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1,307 adults. Fieldwork was undertaken Sep. 11-12. The survey was carried out online and meets rigorous quality standards. It employed a non probability-based sample using both quotas upfront during collection and then a weighting scheme on the back end designed and proven to provide nationally representative results.

What’s next?

- Ready to take leap? Read through our guide to cord-cutting.

- Check out our review of streaming services to help you decide whether on-demand or live streaming is best for you.

- We also tested the different devices. you may need.

- Just need the basics? Consider a TV antenna for free access to local channels.

The cost of streaming

In our survey, we found most respondents subscribe to two or three services. As more and more streaming services continue to pop up, keeping an eye on the number of subscriptions is important. In 2025, ad‑supported tiers capture a growing share of new sign‑ups, and many households actively rotate services to match new seasons—tactics that help control costs Antenna Deloitte Digital Media Trends.

“One service here for $7.99 per month, another there for $4.99 per month, and before you know it, you’re signed up to half a dozen services and easily paying $40-50 dollars per month for them. People are starting to become more conscious or at least aware of that, and streaming service fatigue is starting to get real.”

Sam Cook cord-cutting expert at Flixed.io.

On‑demand prices now vary by ad tier. Examples: Netflix Standard with ads $6.99/month; Standard $15.49; Premium $22.99. Hulu (on‑demand) is $7.99 with ads or $17.99 ad‑free. Paramount+ is $7.99 for Essential (ads) or $12.99 for Paramount+ with SHOWTIME. A three‑service ad‑supported stack can be ~$23–$26/month; ad‑free trios often total ~$40–$50/month Netflix plans Hulu pricing Paramount+ pricing. By contrast, live TV streaming bundles cluster around $73–$95+ before add‑ons (YouTube TV $72.99; Hulu + Live TV $76.99–$89.99; Fubo RSN fee adds ~$11–$14 in many markets).

Cord-cutters should also consider the cost of equipment. Different streaming services are compatible with different devices. Many smart TVs now ship with Roku TV, Fire TV, or Google TV built in, eliminating the need for a dongle. If you do need hardware, 2025 devices add faster Wi‑Fi (6/6E), AV1 decoding, and broader HDR/Atmos support. Standouts include Walmart’s onn. 4K Pro (Google TV) at under $50 with Ethernet, AV1, and a backlit remote onn. 4K Pro review; Amazon’s Fire TV Stick 4K Max with Wi‑Fi 6E and AI‑assisted search Fire TV AI search; Roku’s latest OS features for Live TV and Sports Roku OS 12.5; and Apple TV 4K’s premium performance with tvOS 18 features like InSight and enhanced subtitles tvOS 18. Android/Google TV platform updates also improve performance and sign‑in reliability Android 14 for TV.

From our survey, we learned that 81% of cord-cutters are spending less money than they were on traditional cable or satellite. There’s a good chance you will too—especially if you avoid full live‑TV bundles and rotate on‑demand apps—but be sure to model your lineup. Many households keep TV costs near ~$25–$50/month using ad‑supported tiers and seasonal stacking, while sports‑heavy packages can approach cable‑like totals. Notably, consumers rate streaming higher on satisfaction than traditional pay‑TV ACSI.

There’s still one contract you need

Not every cord can be cut — to use streaming service alternatives, you’ll still need an internet connection. And internet packages still come with contracts, price hikes, and fees. Sometimes, adding a cable channel package for $10-$30 more won’t seem so unreasonable. When reviewing internet providers, we found some providers offer bundles that actually make it cheaper to add TV channels than to purchase an internet-only package. For streaming performance, plan bandwidth based on your household: most homes stream comfortably on 100–300 Mbps down with 10–20 Mbps up; larger families and heavy creators benefit from 300–1000 Mbps down and 20–35+ Mbps up. Per‑stream guidance remains steady—about 5 Mbps for 1080p and ~15 Mbps for 4K on Netflix; YouTube TV recommends ~7+ Mbps for one HD stream and ~13+ Mbps for 4K Netflix speed recommendations YouTube TV bandwidth guidance. Favor fiber where available for low latency and strong uploads; fixed wireless (5G home) can be cost‑effective in many areas; satellite is typically a last resort due to higher latency Google Fiber plans T‑Mobile 5G Home Internet Starlink Residential.

Another thing to keep in mind: If you switch entirely to streaming your TV content, you’ll need a more reliable internet connection. If you don’t have a strong connection (and sometimes even when you do), you might experience buffering when streaming — and no one wants their stream to stop in the middle of a dramatic confrontation or climactic action scene. Higher resolutions and multiple users will require more bandwidth, which comes at a higher cost. A single 4K stream can consume up to ~7 GB/hour; multiple concurrent 4K streams add up quickly. Check for data caps and “Broadband Facts” labels before you buy, and optimize your home network with modern Wi‑Fi 6/6E (or Ethernet for stationary TVs). Mesh systems help large or multi‑story homes. Wi‑Fi 7 is rolling out with higher throughput and lower latency features that further reduce congestion in busy environments Netflix data usage Wi‑Fi 7 overview.

So, is it worth it?

Price alone doesn’t necessarily dictate whether cord-cutting is worth it. Your bottom line might be similar, but the freedom and flexibility that switching to streaming offers is enticing. Streaming leads U.S. TV usage in 2025 and pay‑TV continues to contract, yet the best value depends on your mix. If you can rely on a few on‑demand services (often $25–$50/month with ads), streaming typically undercuts cable. If you need a full cable‑like live bundle ($73–$95+ before add‑ons) for sports and news, savings may narrow. Sports aggregation is improving—Venu Sports aims to combine ESPN/FOX/WBD networks in one app—and large vMVPDs like YouTube TV (now over 8 million subscribers) show how many fans combine linear‑style access with SVODs Nielsen’s The Gauge Venu Sports YouTube TV subscriber milestone.

Streaming services also allow for more flexibility in how you watch. You can view content on TVs, laptops, tablets, phones, game consoles, streaming devices, etc. You can download content to watch offline and can log in when away from home at hotels and Airbnbs. Month‑to‑month terms, ad‑supported entry tiers, and occasional annual discounts give you more control—though churn is naturally higher than legacy TV, which is why bundles and annual plans are increasingly common Antenna Deloitte.

Cord-cutting expert Sam Cook also told us that you should remain vigilant about your streaming set up by “limiting how many you’re signed up for, and taking full advantage of no long-term contracts by binge-watching series on-demand on various services, and then canceling or suspending your account until you need it again.” With free trials and no cancellation fees, it’s becoming increasingly popular to sign up for services for short-term stints. In practice, this is the “rotate and save” strategy many households use to keep costs predictable while still catching tentpole releases Antenna.

There are more nuanced perks to cutting the cord, too. The interface on streaming devices keeps improving: Fire TV added generative‑AI search for natural‑language discovery, Roku sharpened its Sports and Live TV hubs, and Apple’s tvOS 18 brings features like InSight and better subtitles—no clunky cable boxes required Fire TV AI Roku OS 12.5 tvOS 18.

Our recommendation: Before joining the cord-cutters, consider what you want to watch, calculate your current internet provider packages, and research potential streaming services. Make sure the end result aligns with your goals, whether that’s saving money, freeing yourself from cable contracts, or something else. Some people will find better value bundling traditional services, but many will find more freedom and lower bills after cutting the cord. Use ad‑supported tiers, rotate services, and lean on FAST to minimize spend—and map your sports needs carefully to avoid overbuying.

Study Methodology

Reviews.com commissioned YouGov Plc to conduct the survey. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1,307 adults. Fieldwork was undertaken Sep. 11-12. The survey was carried out online and meets rigorous quality standards. It employed a non probability-based sample using both quotas upfront during collection and then a weighting scheme on the back end designed and proven to provide nationally representative results.

What’s next?

- Ready to take leap? Read through our guide to cord-cutting.

- Check out our review of streaming services to help you decide whether on-demand or live streaming is best for you.

- We also tested the different devices. you may need.

- Just need the basics? Consider a TV antenna for free access to local channels.

The cost of cable

A monthly cable TV rate is typically more complicated than a monthly streaming service fee. Providers add surcharges such as a Broadcast TV fee and, in many markets, a Regional Sports fee—these are not taxes and vary by area. Equipment rentals (set‑top box/DVR) also add up. Once standard rates and fees are included, a mid‑tier cable package for a single TV commonly lands around $105–$165+ before taxes Xfinity: Broadcast TV & RSN fees DIRECTV: Regional Sports Fee.

But the cost also depends on the exact package you pay for from a cable provider. John Griffiths, VP of Marketing and Business Development for Spicy Mango, told us, “Quite often there are discounts for taking multiple services, i.e. broadband, telephone, TV, mobile and out of home wi-fi access. To call your total cable package just TV would be misleading as there are all these additional services bundled in.” In 2025, operators and streamers also offer discounted cross‑service bundles—Comcast’s StreamSaver (Peacock + Netflix + Apple TV+) is one example of re‑bundling to restore value Comcast StreamSaver.

We recommend thinking about the sum of your home service needs. If you’ve bundled services, you might only be paying $10-$20 for the TV portion of your contract, which could be cheaper than a streaming package if you value those live channels. Always factor in provider surcharges and equipment, and compare them against a streaming mix plus your broadband cost.

The cost of streaming

In our survey, we found most respondents subscribe to two or three services. As more and more streaming services continue to pop up, keeping an eye on the number of subscriptions is important. In 2025, ad‑supported tiers capture a growing share of new sign‑ups, and many households actively rotate services to match new seasons—tactics that help control costs Antenna Deloitte Digital Media Trends.

“One service here for $7.99 per month, another there for $4.99 per month, and before you know it, you’re signed up to half a dozen services and easily paying $40-50 dollars per month for them. People are starting to become more conscious or at least aware of that, and streaming service fatigue is starting to get real.”

Sam Cook cord-cutting expert at Flixed.io.

On‑demand prices now vary by ad tier. Examples: Netflix Standard with ads $6.99/month; Standard $15.49; Premium $22.99. Hulu (on‑demand) is $7.99 with ads or $17.99 ad‑free. Paramount+ is $7.99 for Essential (ads) or $12.99 for Paramount+ with SHOWTIME. A three‑service ad‑supported stack can be ~$23–$26/month; ad‑free trios often total ~$40–$50/month Netflix plans Hulu pricing Paramount+ pricing. By contrast, live TV streaming bundles cluster around $73–$95+ before add‑ons (YouTube TV $72.99; Hulu + Live TV $76.99–$89.99; Fubo RSN fee adds ~$11–$14 in many markets).

Cord-cutters should also consider the cost of equipment. Different streaming services are compatible with different devices. Many smart TVs now ship with Roku TV, Fire TV, or Google TV built in, eliminating the need for a dongle. If you do need hardware, 2025 devices add faster Wi‑Fi (6/6E), AV1 decoding, and broader HDR/Atmos support. Standouts include Walmart’s onn. 4K Pro (Google TV) at under $50 with Ethernet, AV1, and a backlit remote onn. 4K Pro review; Amazon’s Fire TV Stick 4K Max with Wi‑Fi 6E and AI‑assisted search Fire TV AI search; Roku’s latest OS features for Live TV and Sports Roku OS 12.5; and Apple TV 4K’s premium performance with tvOS 18 features like InSight and enhanced subtitles tvOS 18. Android/Google TV platform updates also improve performance and sign‑in reliability Android 14 for TV.

From our survey, we learned that 81% of cord-cutters are spending less money than they were on traditional cable or satellite. There’s a good chance you will too—especially if you avoid full live‑TV bundles and rotate on‑demand apps—but be sure to model your lineup. Many households keep TV costs near ~$25–$50/month using ad‑supported tiers and seasonal stacking, while sports‑heavy packages can approach cable‑like totals. Notably, consumers rate streaming higher on satisfaction than traditional pay‑TV ACSI.

There’s still one contract you need

Not every cord can be cut — to use streaming service alternatives, you’ll still need an internet connection. And internet packages still come with contracts, price hikes, and fees. Sometimes, adding a cable channel package for $10-$30 more won’t seem so unreasonable. When reviewing internet providers, we found some providers offer bundles that actually make it cheaper to add TV channels than to purchase an internet-only package. For streaming performance, plan bandwidth based on your household: most homes stream comfortably on 100–300 Mbps down with 10–20 Mbps up; larger families and heavy creators benefit from 300–1000 Mbps down and 20–35+ Mbps up. Per‑stream guidance remains steady—about 5 Mbps for 1080p and ~15 Mbps for 4K on Netflix; YouTube TV recommends ~7+ Mbps for one HD stream and ~13+ Mbps for 4K Netflix speed recommendations YouTube TV bandwidth guidance. Favor fiber where available for low latency and strong uploads; fixed wireless (5G home) can be cost‑effective in many areas; satellite is typically a last resort due to higher latency Google Fiber plans T‑Mobile 5G Home Internet Starlink Residential.

Another thing to keep in mind: If you switch entirely to streaming your TV content, you’ll need a more reliable internet connection. If you don’t have a strong connection (and sometimes even when you do), you might experience buffering when streaming — and no one wants their stream to stop in the middle of a dramatic confrontation or climactic action scene. Higher resolutions and multiple users will require more bandwidth, which comes at a higher cost. A single 4K stream can consume up to ~7 GB/hour; multiple concurrent 4K streams add up quickly. Check for data caps and “Broadband Facts” labels before you buy, and optimize your home network with modern Wi‑Fi 6/6E (or Ethernet for stationary TVs). Mesh systems help large or multi‑story homes. Wi‑Fi 7 is rolling out with higher throughput and lower latency features that further reduce congestion in busy environments Netflix data usage Wi‑Fi 7 overview.

So, is it worth it?

Price alone doesn’t necessarily dictate whether cord-cutting is worth it. Your bottom line might be similar, but the freedom and flexibility that switching to streaming offers is enticing. Streaming leads U.S. TV usage in 2025 and pay‑TV continues to contract, yet the best value depends on your mix. If you can rely on a few on‑demand services (often $25–$50/month with ads), streaming typically undercuts cable. If you need a full cable‑like live bundle ($73–$95+ before add‑ons) for sports and news, savings may narrow. Sports aggregation is improving—Venu Sports aims to combine ESPN/FOX/WBD networks in one app—and large vMVPDs like YouTube TV (now over 8 million subscribers) show how many fans combine linear‑style access with SVODs Nielsen’s The Gauge Venu Sports YouTube TV subscriber milestone.

Streaming services also allow for more flexibility in how you watch. You can view content on TVs, laptops, tablets, phones, game consoles, streaming devices, etc. You can download content to watch offline and can log in when away from home at hotels and Airbnbs. Month‑to‑month terms, ad‑supported entry tiers, and occasional annual discounts give you more control—though churn is naturally higher than legacy TV, which is why bundles and annual plans are increasingly common Antenna Deloitte.

Cord-cutting expert Sam Cook also told us that you should remain vigilant about your streaming set up by “limiting how many you’re signed up for, and taking full advantage of no long-term contracts by binge-watching series on-demand on various services, and then canceling or suspending your account until you need it again.” With free trials and no cancellation fees, it’s becoming increasingly popular to sign up for services for short-term stints. In practice, this is the “rotate and save” strategy many households use to keep costs predictable while still catching tentpole releases Antenna.

There are more nuanced perks to cutting the cord, too. The interface on streaming devices keeps improving: Fire TV added generative‑AI search for natural‑language discovery, Roku sharpened its Sports and Live TV hubs, and Apple’s tvOS 18 brings features like InSight and better subtitles—no clunky cable boxes required Fire TV AI Roku OS 12.5 tvOS 18.

Our recommendation: Before joining the cord-cutters, consider what you want to watch, calculate your current internet provider packages, and research potential streaming services. Make sure the end result aligns with your goals, whether that’s saving money, freeing yourself from cable contracts, or something else. Some people will find better value bundling traditional services, but many will find more freedom and lower bills after cutting the cord. Use ad‑supported tiers, rotate services, and lean on FAST to minimize spend—and map your sports needs carefully to avoid overbuying.

Study Methodology

Reviews.com commissioned YouGov Plc to conduct the survey. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1,307 adults. Fieldwork was undertaken Sep. 11-12. The survey was carried out online and meets rigorous quality standards. It employed a non probability-based sample using both quotas upfront during collection and then a weighting scheme on the back end designed and proven to provide nationally representative results.

What’s next?

- Ready to take leap? Read through our guide to cord-cutting.

- Check out our review of streaming services to help you decide whether on-demand or live streaming is best for you.

- We also tested the different devices. you may need.

- Just need the basics? Consider a TV antenna for free access to local channels.

What are you watching and where can you get it?

A Nielsen report from years past suggested viewers watch only a fraction of the channels they receive. Today, measurement shows a durable shift: Nielsen’s The Gauge has streaming as the largest share of U.S. TV time in 2025. Audit your household’s habits: if most viewing happens in apps, you may not need a traditional bundle; if your must‑haves are local news and live sports, you’ll want to map those rights to specific services.

If your household favors the big cable networks like ABC, CBS, NBC, and live sports from the NBA or NFL, you aren’t completely beholden to traditional cable TV. There are streaming services that connect you to live TV channels — like Sling, Youtube TV, and AT&T TV Now. A live TV streaming service typically costs $73–$95+ today depending on the plan and market fees, and you can avoid long‑term contracts. Rights for marquee leagues increasingly split across linear and streaming—plus a new multi‑network sports joint venture aims to aggregate ESPN, FOX, and WBD sports networks in one app, potentially reducing the need for a full vMVPD for some fans Venu Sports.

When it comes to on-demand streaming services, there’s a good chance you’re already subscribed regardless of whether you pay for a cable TV package. Services like Netflix, HBO, and Amazon Prime Video now offer ad‑supported entry tiers at lower prices, and content strategies increasingly include live elements to retain subscribers—for example, Netflix became the exclusive U.S. home of WWE Raw beginning in 2025 Netflix–WWE Raw announcement. If most of your time goes to a short list of apps, those may be enough without a cable contract.

After you’ve surveyed your viewing habits, you may find there are cheaper ways to watch your favorite shows or that you’re subscribed to platforms you don’t need. But don’t snip that cable just yet. If you discover your household frequents channels you can’t get in one streaming package, there’s a chance a traditional cable subscription might still be the best fit for you. Let’s dig into the major costs for each kind of setup.

The cost of cable

A monthly cable TV rate is typically more complicated than a monthly streaming service fee. Providers add surcharges such as a Broadcast TV fee and, in many markets, a Regional Sports fee—these are not taxes and vary by area. Equipment rentals (set‑top box/DVR) also add up. Once standard rates and fees are included, a mid‑tier cable package for a single TV commonly lands around $105–$165+ before taxes Xfinity: Broadcast TV & RSN fees DIRECTV: Regional Sports Fee.

But the cost also depends on the exact package you pay for from a cable provider. John Griffiths, VP of Marketing and Business Development for Spicy Mango, told us, “Quite often there are discounts for taking multiple services, i.e. broadband, telephone, TV, mobile and out of home wi-fi access. To call your total cable package just TV would be misleading as there are all these additional services bundled in.” In 2025, operators and streamers also offer discounted cross‑service bundles—Comcast’s StreamSaver (Peacock + Netflix + Apple TV+) is one example of re‑bundling to restore value Comcast StreamSaver.

We recommend thinking about the sum of your home service needs. If you’ve bundled services, you might only be paying $10-$20 for the TV portion of your contract, which could be cheaper than a streaming package if you value those live channels. Always factor in provider surcharges and equipment, and compare them against a streaming mix plus your broadband cost.

The cost of streaming

In our survey, we found most respondents subscribe to two or three services. As more and more streaming services continue to pop up, keeping an eye on the number of subscriptions is important. In 2025, ad‑supported tiers capture a growing share of new sign‑ups, and many households actively rotate services to match new seasons—tactics that help control costs Antenna Deloitte Digital Media Trends.

“One service here for $7.99 per month, another there for $4.99 per month, and before you know it, you’re signed up to half a dozen services and easily paying $40-50 dollars per month for them. People are starting to become more conscious or at least aware of that, and streaming service fatigue is starting to get real.”

Sam Cook cord-cutting expert at Flixed.io.

On‑demand prices now vary by ad tier. Examples: Netflix Standard with ads $6.99/month; Standard $15.49; Premium $22.99. Hulu (on‑demand) is $7.99 with ads or $17.99 ad‑free. Paramount+ is $7.99 for Essential (ads) or $12.99 for Paramount+ with SHOWTIME. A three‑service ad‑supported stack can be ~$23–$26/month; ad‑free trios often total ~$40–$50/month Netflix plans Hulu pricing Paramount+ pricing. By contrast, live TV streaming bundles cluster around $73–$95+ before add‑ons (YouTube TV $72.99; Hulu + Live TV $76.99–$89.99; Fubo RSN fee adds ~$11–$14 in many markets).

Cord-cutters should also consider the cost of equipment. Different streaming services are compatible with different devices. Many smart TVs now ship with Roku TV, Fire TV, or Google TV built in, eliminating the need for a dongle. If you do need hardware, 2025 devices add faster Wi‑Fi (6/6E), AV1 decoding, and broader HDR/Atmos support. Standouts include Walmart’s onn. 4K Pro (Google TV) at under $50 with Ethernet, AV1, and a backlit remote onn. 4K Pro review; Amazon’s Fire TV Stick 4K Max with Wi‑Fi 6E and AI‑assisted search Fire TV AI search; Roku’s latest OS features for Live TV and Sports Roku OS 12.5; and Apple TV 4K’s premium performance with tvOS 18 features like InSight and enhanced subtitles tvOS 18. Android/Google TV platform updates also improve performance and sign‑in reliability Android 14 for TV.

From our survey, we learned that 81% of cord-cutters are spending less money than they were on traditional cable or satellite. There’s a good chance you will too—especially if you avoid full live‑TV bundles and rotate on‑demand apps—but be sure to model your lineup. Many households keep TV costs near ~$25–$50/month using ad‑supported tiers and seasonal stacking, while sports‑heavy packages can approach cable‑like totals. Notably, consumers rate streaming higher on satisfaction than traditional pay‑TV ACSI.

There’s still one contract you need

Not every cord can be cut — to use streaming service alternatives, you’ll still need an internet connection. And internet packages still come with contracts, price hikes, and fees. Sometimes, adding a cable channel package for $10-$30 more won’t seem so unreasonable. When reviewing internet providers, we found some providers offer bundles that actually make it cheaper to add TV channels than to purchase an internet-only package. For streaming performance, plan bandwidth based on your household: most homes stream comfortably on 100–300 Mbps down with 10–20 Mbps up; larger families and heavy creators benefit from 300–1000 Mbps down and 20–35+ Mbps up. Per‑stream guidance remains steady—about 5 Mbps for 1080p and ~15 Mbps for 4K on Netflix; YouTube TV recommends ~7+ Mbps for one HD stream and ~13+ Mbps for 4K Netflix speed recommendations YouTube TV bandwidth guidance. Favor fiber where available for low latency and strong uploads; fixed wireless (5G home) can be cost‑effective in many areas; satellite is typically a last resort due to higher latency Google Fiber plans T‑Mobile 5G Home Internet Starlink Residential.

Another thing to keep in mind: If you switch entirely to streaming your TV content, you’ll need a more reliable internet connection. If you don’t have a strong connection (and sometimes even when you do), you might experience buffering when streaming — and no one wants their stream to stop in the middle of a dramatic confrontation or climactic action scene. Higher resolutions and multiple users will require more bandwidth, which comes at a higher cost. A single 4K stream can consume up to ~7 GB/hour; multiple concurrent 4K streams add up quickly. Check for data caps and “Broadband Facts” labels before you buy, and optimize your home network with modern Wi‑Fi 6/6E (or Ethernet for stationary TVs). Mesh systems help large or multi‑story homes. Wi‑Fi 7 is rolling out with higher throughput and lower latency features that further reduce congestion in busy environments Netflix data usage Wi‑Fi 7 overview.

So, is it worth it?

Price alone doesn’t necessarily dictate whether cord-cutting is worth it. Your bottom line might be similar, but the freedom and flexibility that switching to streaming offers is enticing. Streaming leads U.S. TV usage in 2025 and pay‑TV continues to contract, yet the best value depends on your mix. If you can rely on a few on‑demand services (often $25–$50/month with ads), streaming typically undercuts cable. If you need a full cable‑like live bundle ($73–$95+ before add‑ons) for sports and news, savings may narrow. Sports aggregation is improving—Venu Sports aims to combine ESPN/FOX/WBD networks in one app—and large vMVPDs like YouTube TV (now over 8 million subscribers) show how many fans combine linear‑style access with SVODs Nielsen’s The Gauge Venu Sports YouTube TV subscriber milestone.

Streaming services also allow for more flexibility in how you watch. You can view content on TVs, laptops, tablets, phones, game consoles, streaming devices, etc. You can download content to watch offline and can log in when away from home at hotels and Airbnbs. Month‑to‑month terms, ad‑supported entry tiers, and occasional annual discounts give you more control—though churn is naturally higher than legacy TV, which is why bundles and annual plans are increasingly common Antenna Deloitte.

Cord-cutting expert Sam Cook also told us that you should remain vigilant about your streaming set up by “limiting how many you’re signed up for, and taking full advantage of no long-term contracts by binge-watching series on-demand on various services, and then canceling or suspending your account until you need it again.” With free trials and no cancellation fees, it’s becoming increasingly popular to sign up for services for short-term stints. In practice, this is the “rotate and save” strategy many households use to keep costs predictable while still catching tentpole releases Antenna.

There are more nuanced perks to cutting the cord, too. The interface on streaming devices keeps improving: Fire TV added generative‑AI search for natural‑language discovery, Roku sharpened its Sports and Live TV hubs, and Apple’s tvOS 18 brings features like InSight and better subtitles—no clunky cable boxes required Fire TV AI Roku OS 12.5 tvOS 18.

Our recommendation: Before joining the cord-cutters, consider what you want to watch, calculate your current internet provider packages, and research potential streaming services. Make sure the end result aligns with your goals, whether that’s saving money, freeing yourself from cable contracts, or something else. Some people will find better value bundling traditional services, but many will find more freedom and lower bills after cutting the cord. Use ad‑supported tiers, rotate services, and lean on FAST to minimize spend—and map your sports needs carefully to avoid overbuying.

Study Methodology

Reviews.com commissioned YouGov Plc to conduct the survey. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1,307 adults. Fieldwork was undertaken Sep. 11-12. The survey was carried out online and meets rigorous quality standards. It employed a non probability-based sample using both quotas upfront during collection and then a weighting scheme on the back end designed and proven to provide nationally representative results.

What’s next?

- Ready to take leap? Read through our guide to cord-cutting.

- Check out our review of streaming services to help you decide whether on-demand or live streaming is best for you.

- We also tested the different devices. you may need.

- Just need the basics? Consider a TV antenna for free access to local channels.